- Whale activity highlighted market uncertainty as social volume and sentiment charted downtrends.

- Technical indicators and liquidation data confirmed persistent selling pressure and oversold market conditions.

Activities with whales in the Dog Hat (WIF) The market continues to make headlines as a top player recently withdrew $20.77 million from WIF at an average price of $1.73, resulting in a significant loss of $3.27 million of dollars.

However, shortly after, this whale redeposited $17.5 million into Binance, raising questions about its strategic intentions. At press time, WIF was trading at $1.45, following a sharp decline of 6.58% over the past 24 hours.

This combination of large transactions and a falling price highlights the growing uncertainty surrounding WIF’s market performance.

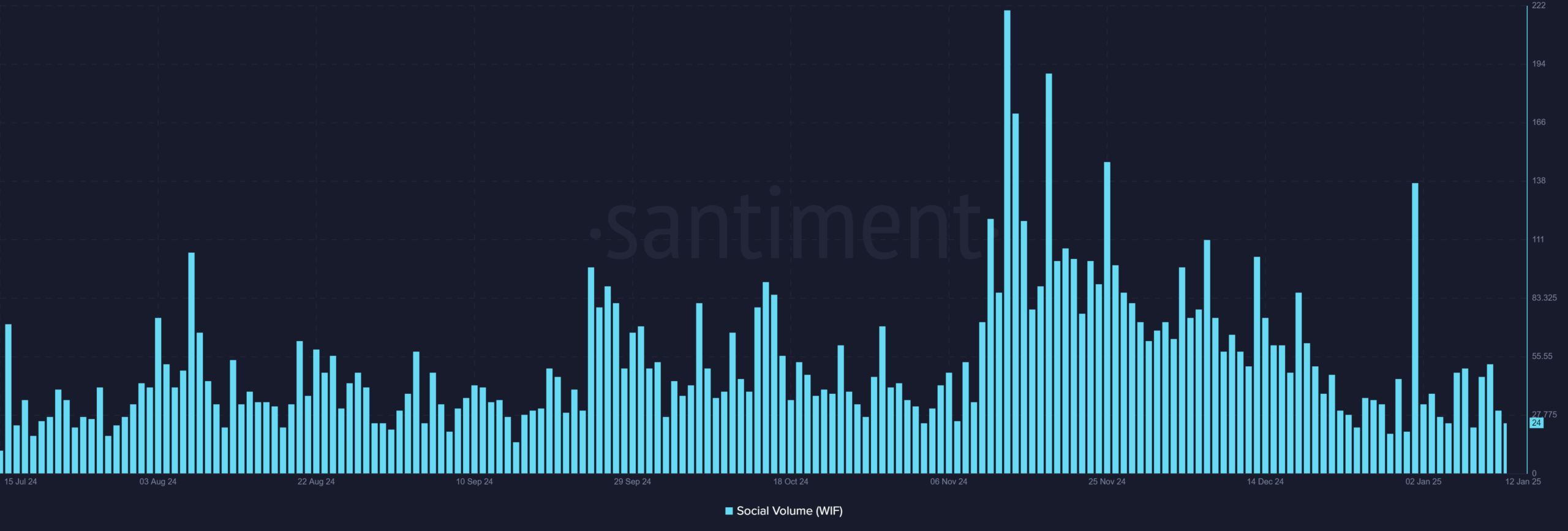

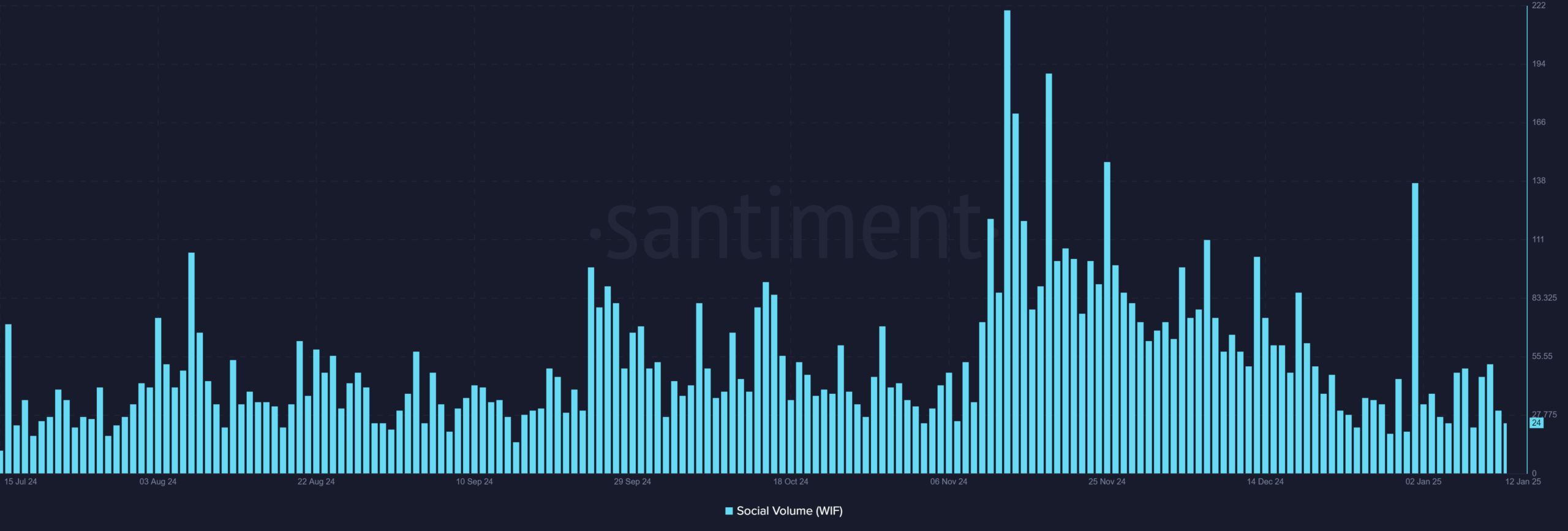

Analysis of WIF social volume reveals decreasing enthusiasm

WIF social volume, a key measure of community interest, has declined significantly in recent times. At press time, the metric had just 24 mentions, which is a sharp drop from its peak of more than 200 mentions in November.

This decline highlighted a decrease in interest and participation from traders and investors. Therefore, this decline in social engagement could hamper WIF’s ability to generate new momentum and sustain business activity in the short term.

Source: Santiment

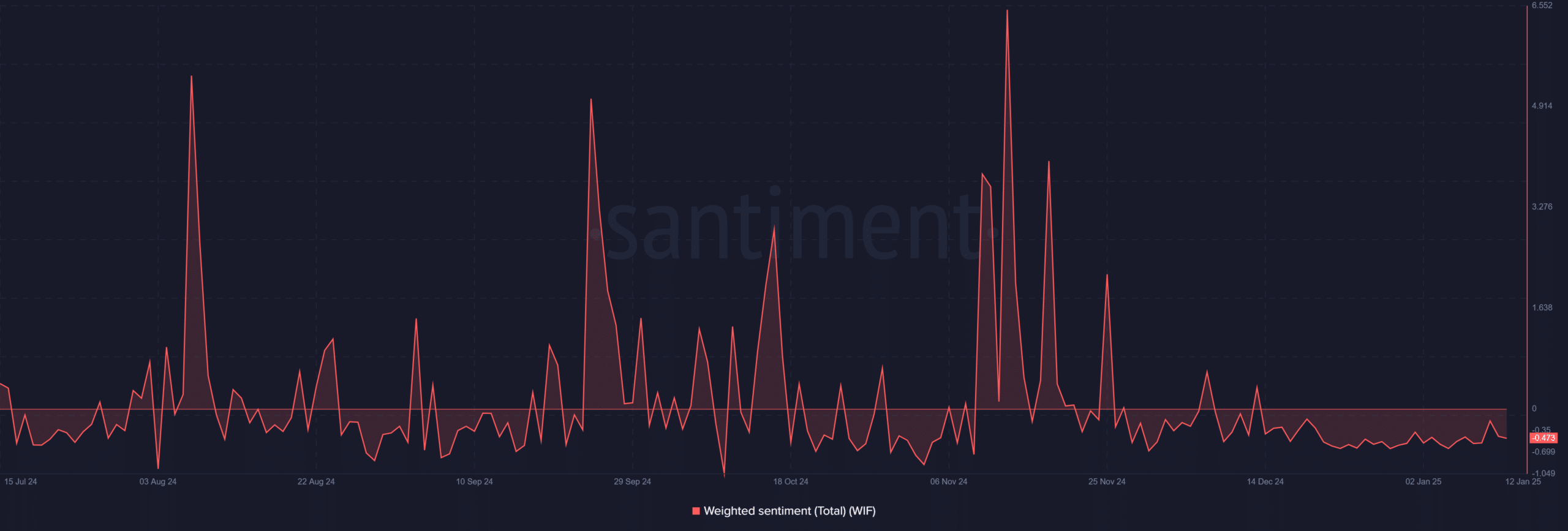

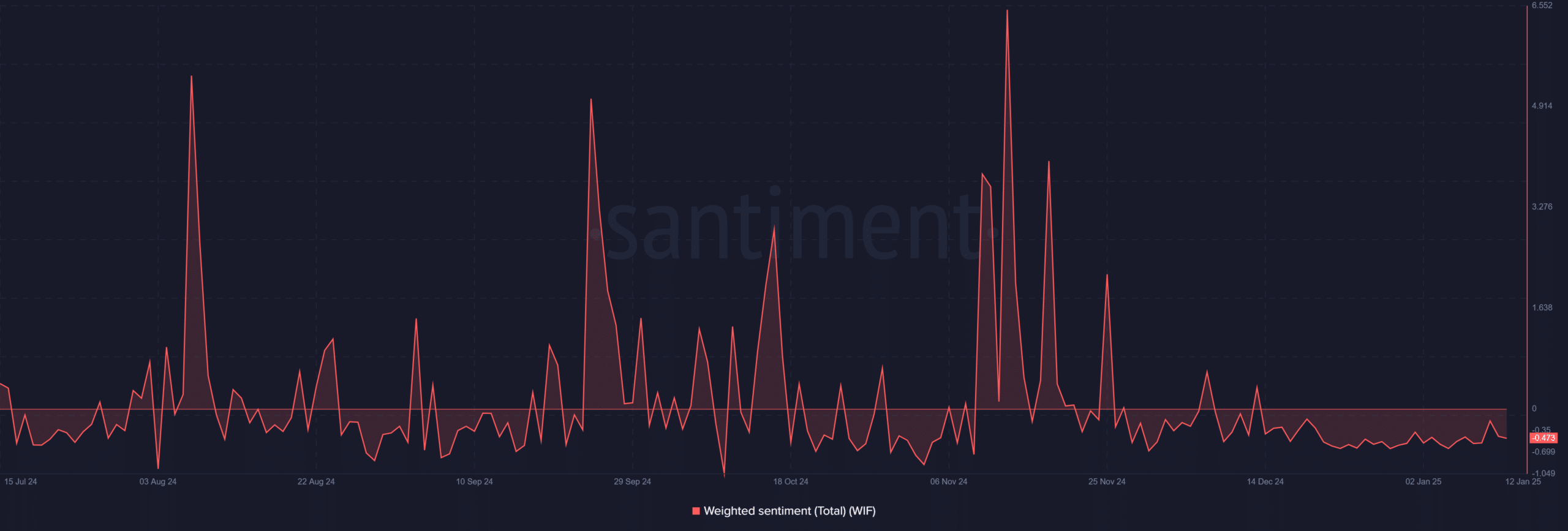

Sentiment Trends Underline Traders’ Cautious Behavior

The weighted sentiment for WIF indicates a notable shift toward caution among traders. On January 13, the indicator recorded a value of -0.473, signaling bearish sentiment. This stands in stark contrast to previous sentiment peaks above 6.5 during periods of high volatility.

Additionally, continued negativity in sentiment suggests traders remain cautious about taking new positions, which could limit upward price movement in the near term. Therefore, sentiment trends hinted at growing skepticism within the market.

Source: Santiment

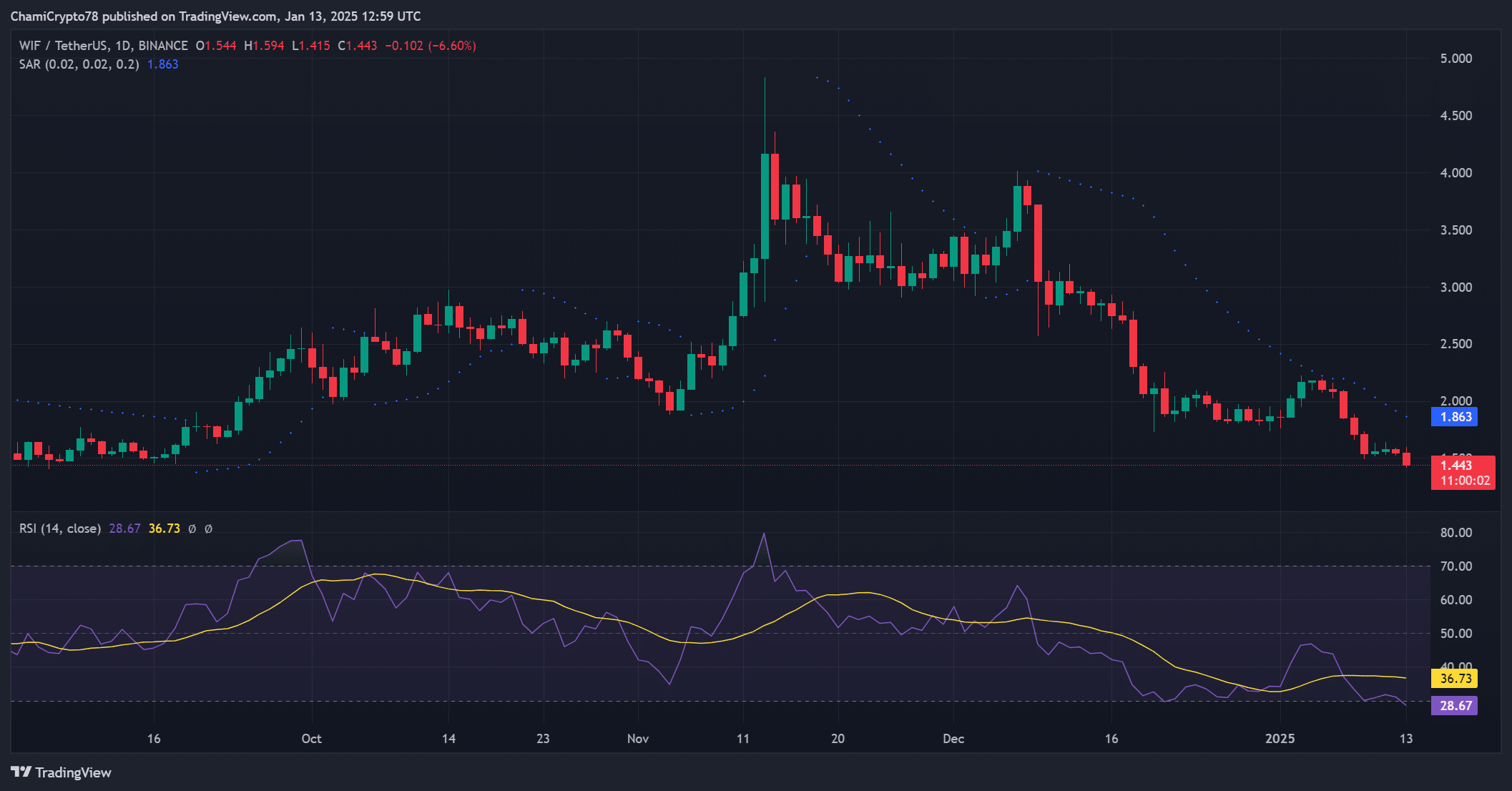

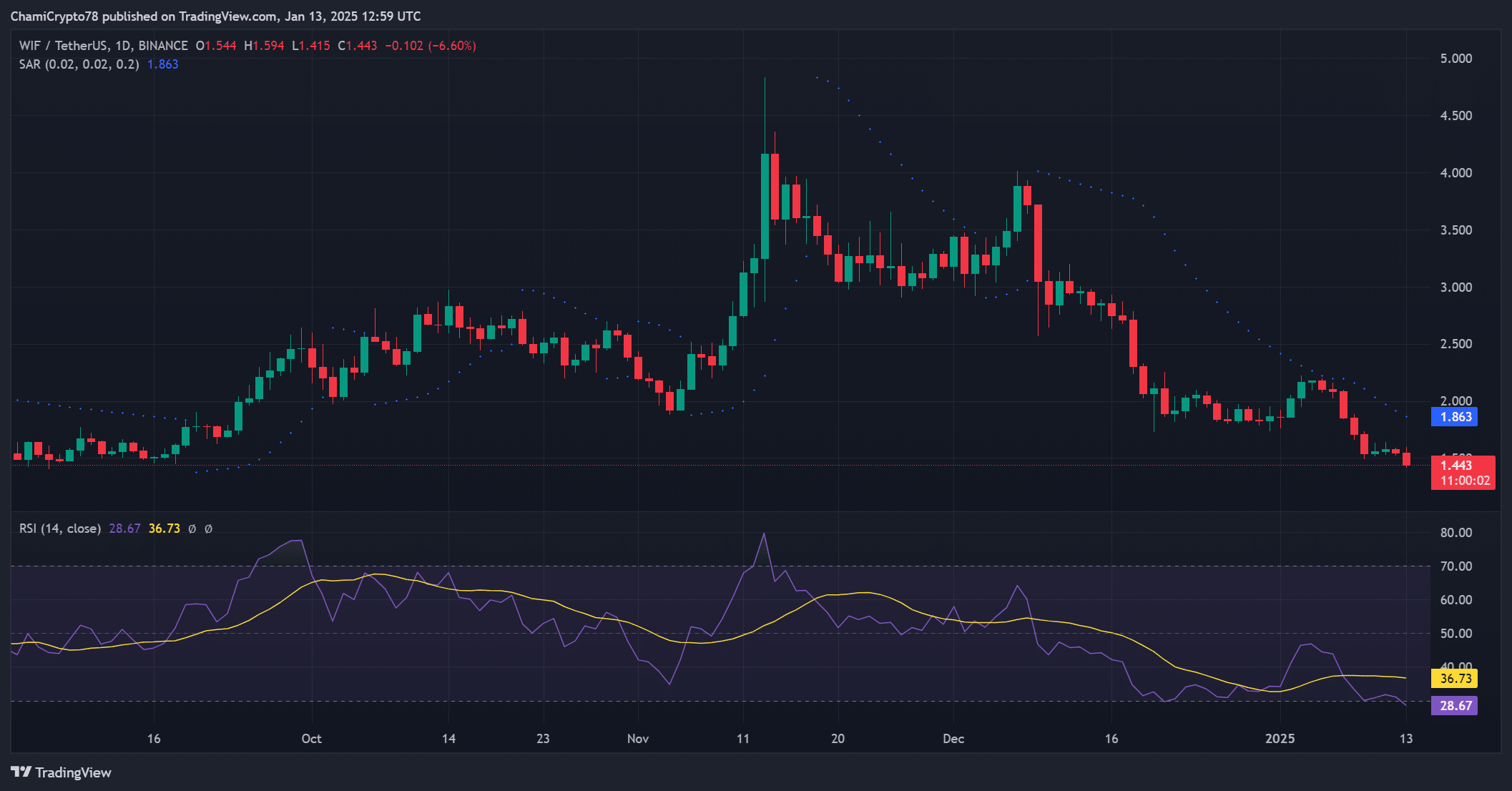

Technical indicators point towards a bearish trend

From a technical perspective, WIF’s current trajectory remains bearish. The Parabolic SAR indicated resistance around $1.86 and the RSI fell to 28.67 – signaling oversold conditions.

Additionally, the 24-hour price drop to $1.45 confirmed sustained selling pressure. Therefore, while oversold conditions may attract opportunistic buyers, the broader technical picture suggests that the downtrend could persist without a significant catalyst to reverse the momentum.

Source: TradingView

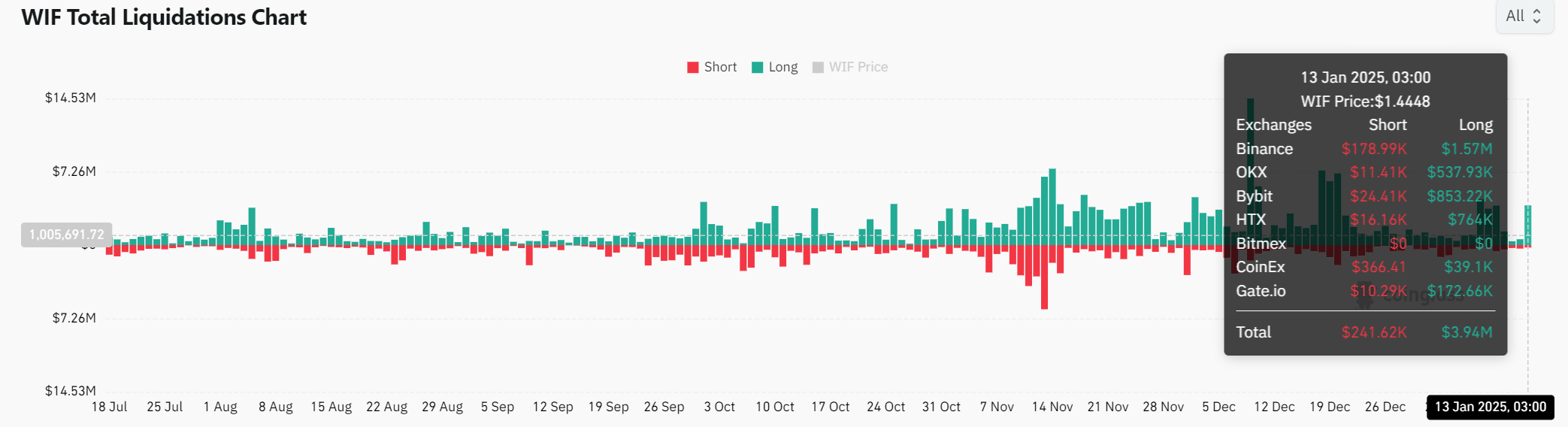

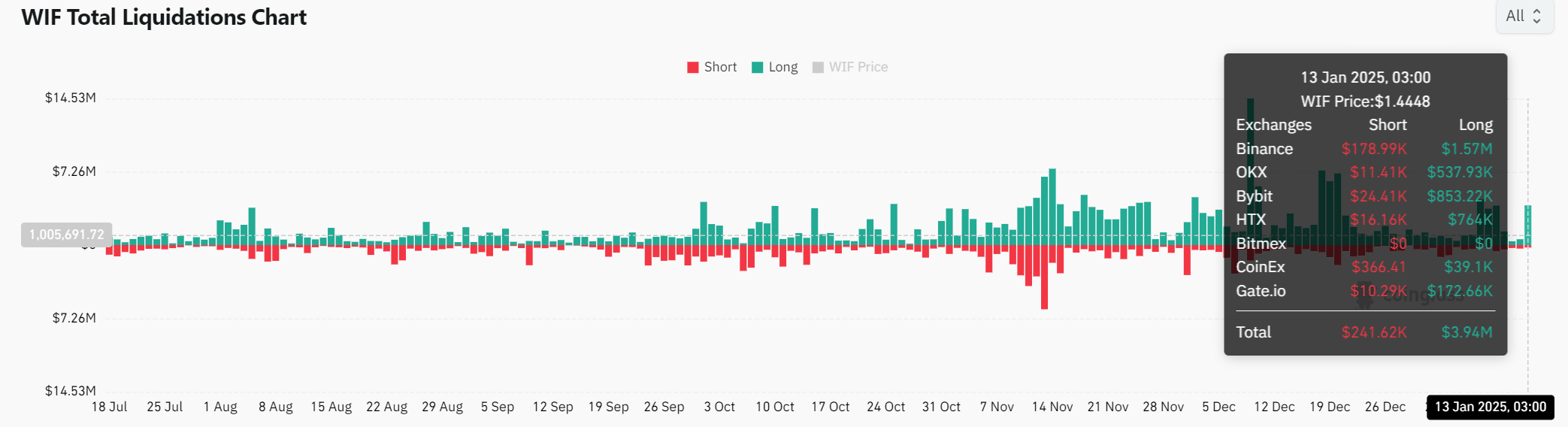

WIF liquidations reveal dominance of long positions

Finally, liquidation data highlighted the risk imbalance in the WIF market, with $3.94 million in long positions liquidated compared to $241,000 in short positions. This disparity underscored traders’ sustained bullish expectations, despite recent price declines.

However, the current price decline suggests that many long positions remain vulnerable to further liquidation, increasing the likelihood of further downward pressure. Therefore, liquidation trends have reinforced the need for prudent business strategies in the current environment.

Source: Coinglass

Read dogwifhat (WIF) price forecast 2024-2025

The WIF market faces significant challenges, with bearish technicals, declining confidence and reduced social engagement creating a difficult environment. While the whale’s re-deposit raised hopes for strategic positioning, broader market indicators pointed to a continuation of the downtrend.

Therefore, unless key indicators such as sentiment and social volume improve, WIF could be poised for further losses in the near term.