The crypto market saw a surge of optimism this morning, pushing Bitcoin and top altcoins to critical levels. This sudden rise results from a convergence of factors: a key political signal, short sellers under pressure and a rise in expectations as the publication of crucial macroeconomic data approaches.

The “CZ forgiveness effect”: a strong political signal for crypto

The main catalyst for this gathering is undoubtedly the presidential pardon granted by Donald Trump has Changpeng “CZ” Zhaothe founder of Binance. This decision was perceived by the entire market as an unequivocal gesture of support from the US administration towards the crypto industry. By making a clean sweep of one of the most influential figures in the sector. Trump sent a clear message that the era of regulatory hostility may be coming to an end.

This signal has revived the confidence of investors who see the promise of a more favorable environment for innovation and adoption. Tokens linked to the Trump ecosystem, such as WLFIhave exploded in value. But the positive shock wave spread to the entire market.

Buy your WLFI and BNB crypto in a few clicks on Bitget and receive a $10 free bonus here:

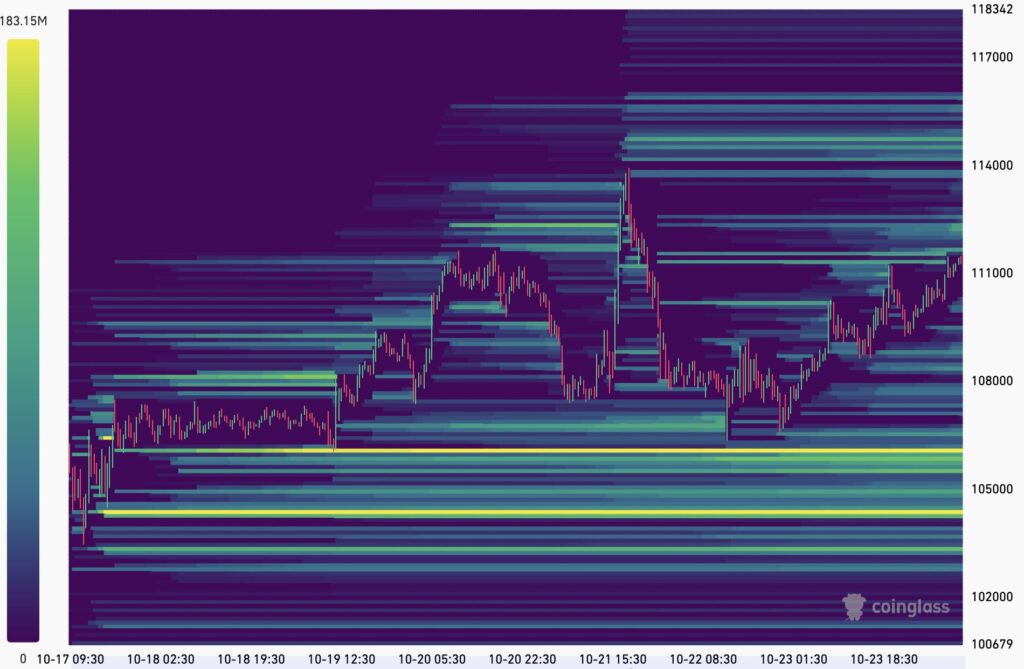

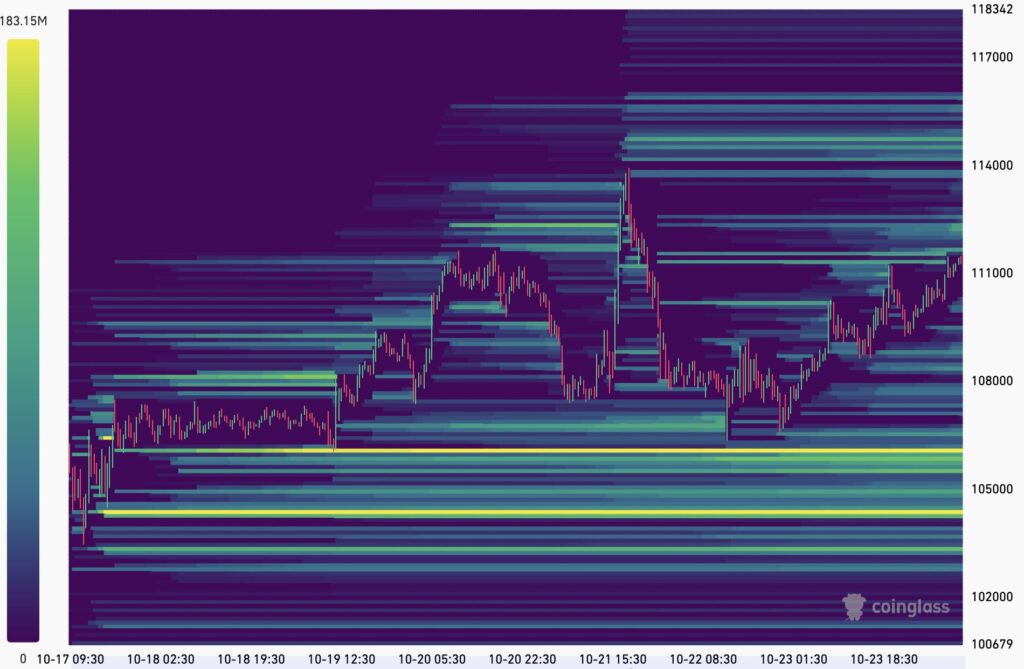

The “Short Squeeze”: Sellers stuck up to $112,200

On a technical level, the rise was violently amplified by a “short squeeze” phenomenon. Many traders had bet on a market decline, placing short sale orders. When the price of Bitcoin started to rise, these positions became losers. The rally accelerated as key levels were breached, culminating in a wave of massive liquidations of short positions until $112,200 area.

Each selloff is a forced buy, creating a positive feedback loop: the rise forces sellers to buy, which fuels the rise even further. This purge of “shorts” cleaned up the market and allowed prices to skyrocket without the selling pressure holding it back.

As Killa points out, more than half of the best traders are net short. Which shows that the majority is currently betting on a decline.

The calm before the storm? Volatility expected with CPI numbers

However, the euphoria of this morning must be tempered. The market is holding its breath in anticipation of today’s inflation data (CPI) released. These numbers are a key indicator of the Federal Reserve’s monetary policy. Higher-than-expected numbers could dash hopes of lower interest rates, which would be negative for risky assets like crypto.

Traders are therefore on alert. The current rally could just be a speculative move in anticipation of good news, but the risk of a violent reaction is very real. Volatility is expected to peak around the time of the announcement, and the direction the market takes for the rest of the week will depend entirely on this crucial number.

Furthermore, the majority of short-term liquidations are now below $107,000. This increases the probability of a reversal and a news sales event.

On the same subject:

DISCLAIMER

This article is for informational purposes only and should not be considered investment advice. Some of the partners featured on this site may not be regulated in your country. It is your responsibility to check that these services comply with local regulations before using them.