Key Notes

- BNB price fell 9.6% but held above $1,000 on Saturday, outperforming rival large-cap cryptocurrencies.

- Data shows traders favored BNB and BTC in “flight to safety” trades amid $19 billion in liquidations.

- The exchange token sector proved more resilient, down just 5.4% compared to the global crypto market’s 9% decline.

The BNB price held above $1,130 on Saturday, October 11, down 9.6%, in line with the broader stock market crash that erased $19 billion from the global cryptocurrency selloff in 24 hours. Still, key market data shows that BNB has demonstrated greater resilience and remains better positioned for a rapid rebound than competing layer 1 tokens.

BNB, BTC Reduce Single-Digit Losses Amid Flight-to-Safety Bets

BNB returned from an all-time high of $1,330 on Monday to a weekly low of $1,043 during Friday’s crash before rebounding to $1,132 at press time. Notably, BNB’s 9.6% intraday loss exceeds its modest 7-day decline of just 1.7%, signaling the re-emergence of strong buying pressure at key psychological levels as weak hands exited.

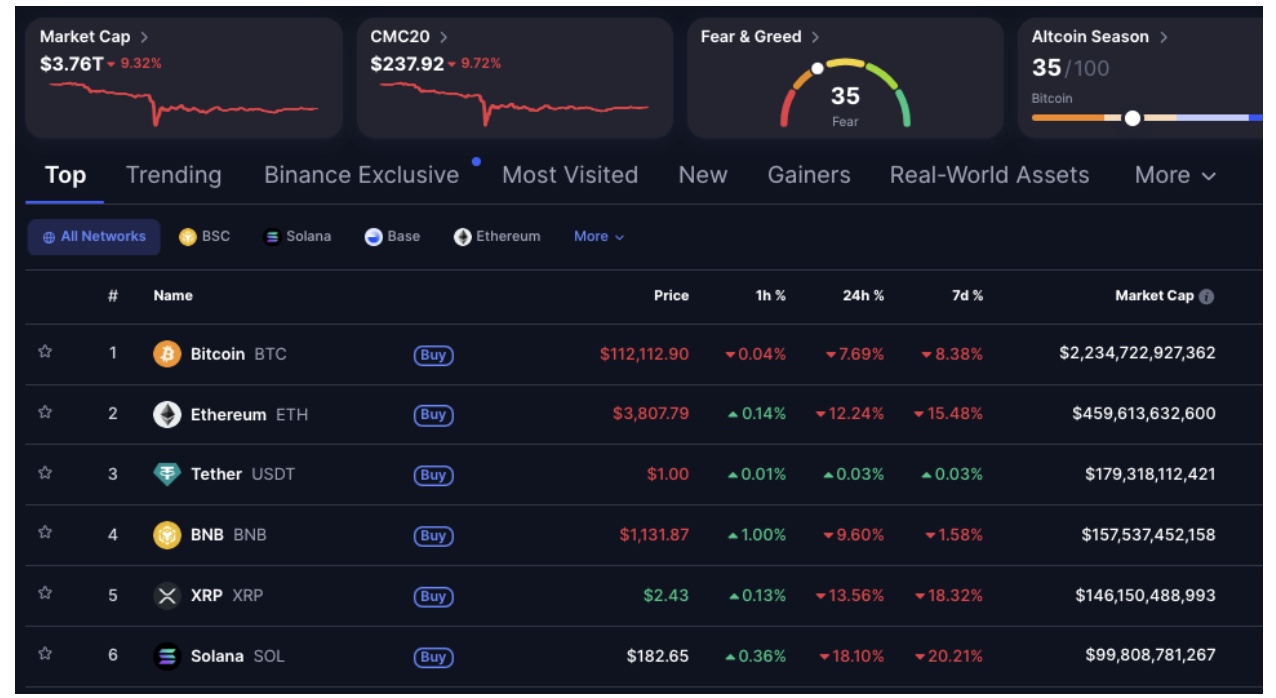

Top 6 cryptocurrency performances on October 11, 2025 | Source: CoinMarketCap

Beyond that, Coinmarketcap data shows that BNB’s limited decline places it alongside Bitcoin (-7.69%) as one of the top five cryptocurrencies maintaining single-digit daily losses, despite market liquidations exceeding $19 billion over the past 24 hours. This highlights an active “flight to safety” rotation into BTC and BNB during the current market decline.

Why is BNB price holding above $1,000?

BNB’s successful defense of $1,000 during the October 11 crypto crash can be attributed to improving sentiment after hitting new all-time highs in three consecutive weeks, and ancillary demand due to market turmoil.

As the native token of Binance, the world’s largest crypto exchange and the second-largest DeFi ecosystem, BNB benefits from multiple demand catalysts, ranging from discounts on trading fees to increased network revenue during increased volatility.

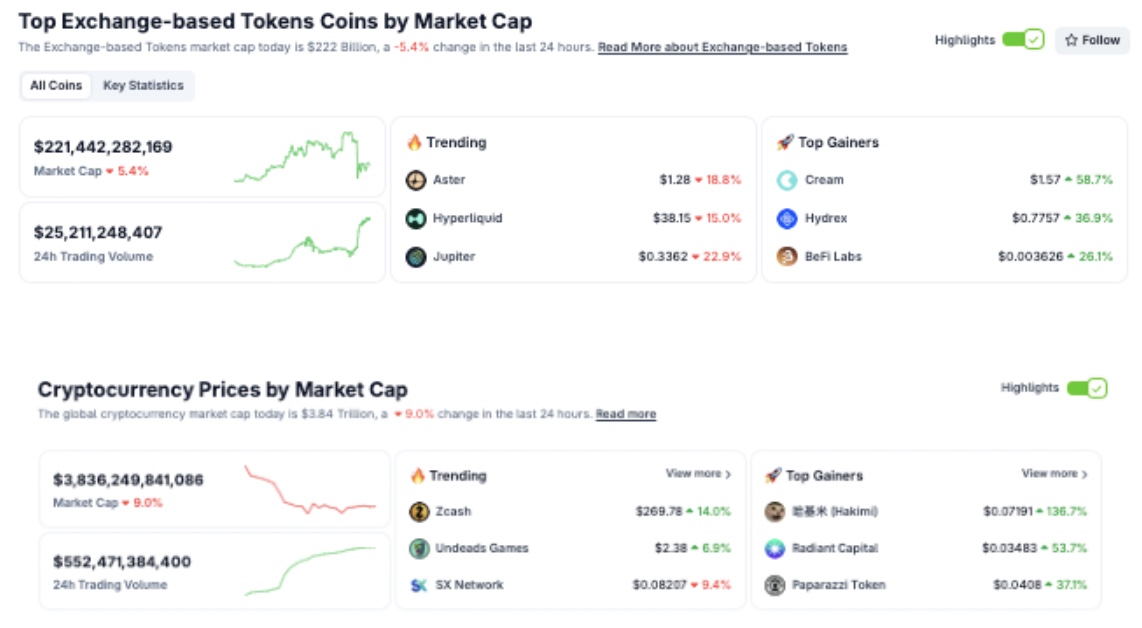

Exchange Token Sector Plunges 5.4% as Global Crypto Market Cap Plunges 9% October 11, 2025 | Source: Coingecko

This dual function makes BNB an interesting hedge in times of market tension. Coingecko’s overall data on the crypto exchange token sector further reflected this narrative on Saturday. As noted above, the exchange token sector declined just 5.4% to $221.4 billion in overall market capitalization on Saturday, outperforming the broader crypto market’s 9% contraction to $3.8 trillion.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with experience supporting various Web3 startups and financial organizations. He completed his undergraduate degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn