The crypto market is down today, with the global cryptocurrency market cap falling 1.0% to $3.74 trillion, according to data from CoinMarketCap. The 24-hour trading volume stood at $238 billion, reflecting a slight slowdown in market activity.

TLDR:

- 8 of the top 10 cryptocurrencies are down;

- BTC -0.8% ($107,735), ETH -1.5% ($3,831);

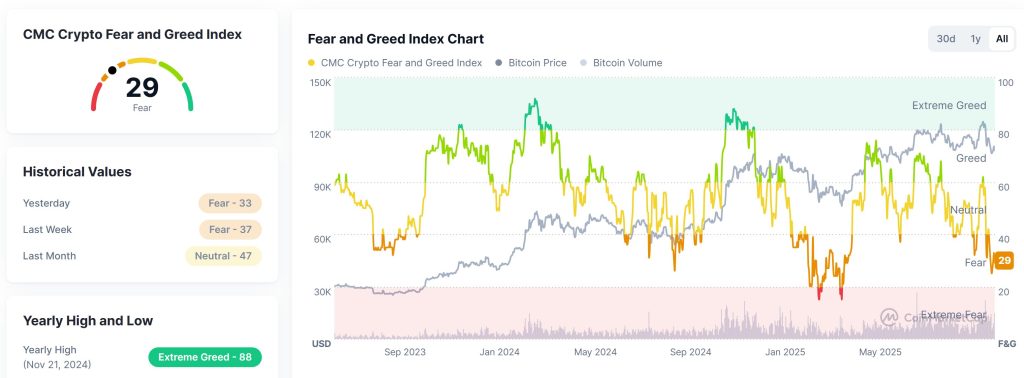

- The fear and greed index dropped to 29 (fear);

- Bitcoin faces resistance between $110,000 and $112,800 and support around $106,600;

- ETH consolidates between $3,750 and $4,250;

- Owen Gunden, the first Bitcoin whale, transferred 364 BTC ($40.25 million) to Kraken;

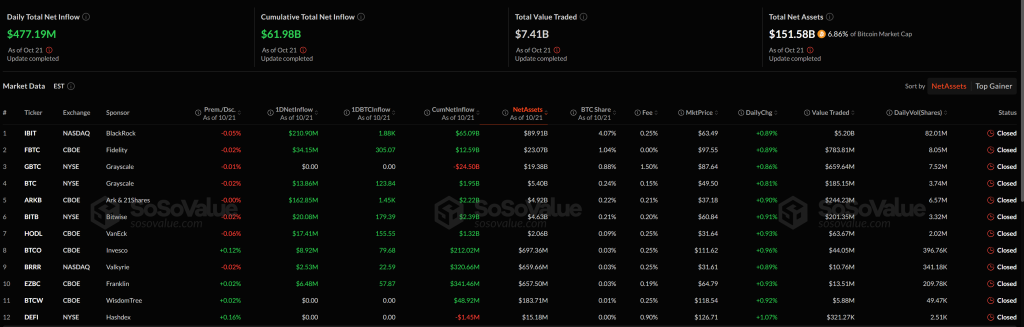

- US spot Bitcoin ETFs saw inflows of $477.19 million;

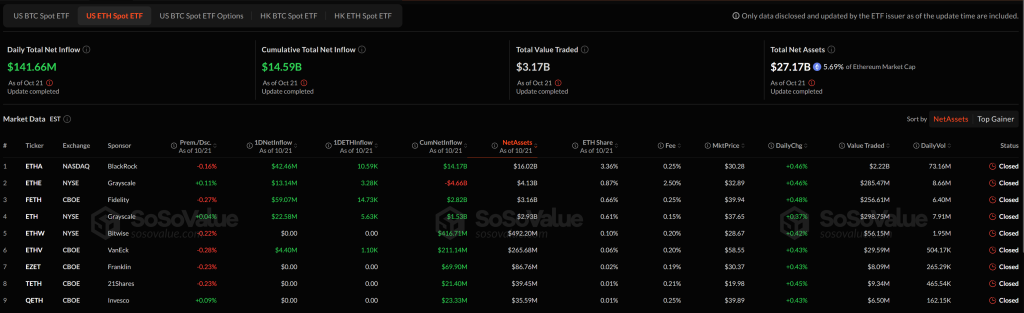

- US spot Ethereum ETFs saw inflows of $141.66 million;

- Retail chain Bealls now accepts crypto payments in 660 US stores;

Crypto Winners and Losers

At the time of writing, 8 of the top 10 cryptocurrencies by market capitalization have traded lower over the past 24 hours, showing continued weakness across major assets.

Bitcoin (BTC) is down 0.8%, trading at $107,735, with a market cap of $2.14 trillion.

Ethereum (ETH) fell 1.5% during the same period to $3,831, while Binance Coin (BNB) fell 0.9% to $1,068.

Among the other key pieces, Solana (SOL) slipped 0.7% to $184.92, and XRP (XRP) fell slightly by 1.4% to $2.40.

The only notable gainer among major assets is Ether staked by the Lido (stETH), up 1.0% in the last 24 hours, trading at $3,828.

Further down the list, Dogecoin (DOGE) lost 1.9% to $0.1909, while Cardano (ADA) fell 1.5% to $0.6358.

Today’s trending tokens include EVAA protocolup 4.0% to $7.39, Asterdown 0.3% to $0.099, and Hyperliquidalmost stable at $35.93.

In the meantime, MybaseCoin topped the ranking of gainers with an increase of 5.6%, followed by EVAA protocol (+4.0%) and GeorgePlaysClashRoyale (+40.2%), marking remarkable performance in an otherwise red market.

Meanwhile, Owen Gunden, the first Bitcoin whale, transferred 364 BTC, worth around $40.25 million, to crypto exchange Kraken today, according to on-chain data. Despite the large deposit, Gunden still holds an impressive 10,959 BTC, valued at approximately $1.19 billion.

US-India trade deal could reshape global capital flows

The United States and India are reportedly close to finalizing a historic trade deal that would reduce tariffs on Indian exports to the United States from around 50% to 15%, marking a significant shift in global trade dynamics.

In exchange, India would gradually reduce its imports of Russian oil and open its agricultural market to more American products. The deal could be announced on October 26-28 at the ASEAN Summit, where President Trump and Prime Minister Modi are expected to meet.

Analysts say the deal could accelerate supply chain realignment in Asia, positioning India as a partial replacement for China’s manufacturing base.

In the crypto market, Bitcoin (BTC) faces dense liquidation zones near $111,000 with support around $106,600, according to CoinGlass data.

Bitunix analysts note that confirmation of the deal could trigger a global revaluation of capital and temporarily dampen risk appetite in crypto. However, they add that long-term trends in dedollarization and the rise of regional settlement systems could strengthen structural demand for digital assets.

Levels and events to watch next

At the time of writing on Wednesday, Bitcoin is trading at $108,137, showing a slight intraday decline of 0.22%. The price briefly fell to an intraday low near $107,500 after failing to hold above $109,000 earlier in the session. BTC has been moving sideways in recent days as traders wait for new macro catalysts.

If Bitcoin breaks above the $110,000 resistance, it could trigger a move towards $112,800 and possibly $115,000, where stronger selling pressure could emerge.

Conversely, a decline below $107,000 could expose the $105,000 level, with a deeper correction likely to revisit the $102,000 support.

Meanwhile, Ethereum is trading around $3,849, down 0.64% over the past 24 hours. ETH has consolidated in a wide range between $3,750 and $4,250 since early October, with declining volume suggesting reduced market participation.

If ETH manages to break above $3,950, the next resistance is around $4,150, followed by $4,400. However, a decline below $3,800 could lead to further decline towards $3,650 and $3,500.

Meanwhile, crypto market sentiment remains deep in the fear zone, with the Crypto Fear and Greed Index falling to 29, signaling increasing caution from traders. The index fell from 33 yesterday to 37 last week, marking a steady decline in investor confidence in recent days.

Compared to last month’s neutral reading of 47, sentiment has clearly weakened as market volatility and profit-taking dominate trading behavior. This represents one of the lowest levels of fear since early 2025, reflecting growing investor uncertainty following Bitcoin’s recent decline below $110,000.

U.S. spot Bitcoin ETFs saw a strong rebound in inflows on October 21, recording a total daily net inflow of $477.19 million, according to SoSoValue data.

BlackRock’s iShares Bitcoin Trust (IBIT) led inflows with $210.9 million, followed by Ark 21Shares (ARKB) with $162.85 million and Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $34.15 million. Other ETFs seeing positive flows include Bitwise (BITB) with $20.08 million and VanEck’s HODL with $17.41 million.

U.S. Ethereum spot ETFs also saw a total daily net inflow of $141.66 million on Oct. 21, according to SoSoValue data.

Among the nine ETFs listed, Fidelity’s FETH led the day with $59.07 million in inflows, followed by BlackRock’s ETHA with $42.46 million and Grayscale’s ETHE with $13.14 million. Grayscale’s ETH fund also saw a healthy inflow of $22.58 million, demonstrating renewed investor interest after weeks of outflows.

Meanwhile, Bealls, a century-old American retail company, is starting to accept crypto payments through a partnership with Flexa at its 660 stores across 22 states.

The article Why is crypto down today? – October 22, 2025 appeared first on Cryptonews.

US retail chain Bealls will operate Flexa Payments, allowing it to accept over 99 cryptos, including memecoins and stablecoins, from over 300 digital wallets.

US retail chain Bealls will operate Flexa Payments, allowing it to accept over 99 cryptos, including memecoins and stablecoins, from over 300 digital wallets.