The cryptocurrency market is trending slightly higher today, with the total cryptocurrency market capitalization increasing by approximately 1.7% over the past 24 hours to approximately $3.22 trillion. Despite this modest gain, price developments on the main assets remain mixed. Total 24-hour trading volume stands at approximately $115.6 billion, indicating stable but moderate activity compared to recent highs.

TLDR:

- The crypto market cap increased by 1.7% in the last 24 hours to $3.22 billion;

- BTC is up 1.7% to near $92,169, while ETH gained 0.7% to $3,136;

- VanEck called 2026 a “risk-on” year, citing clearer visibility on fiscal and monetary policy;

- Bitcoin remains range-bound near $91,000-$92,000 as global stocks recover;

- ETH faces resistance between $3,180 and $3,300 and support between $3,100 and $3,000;

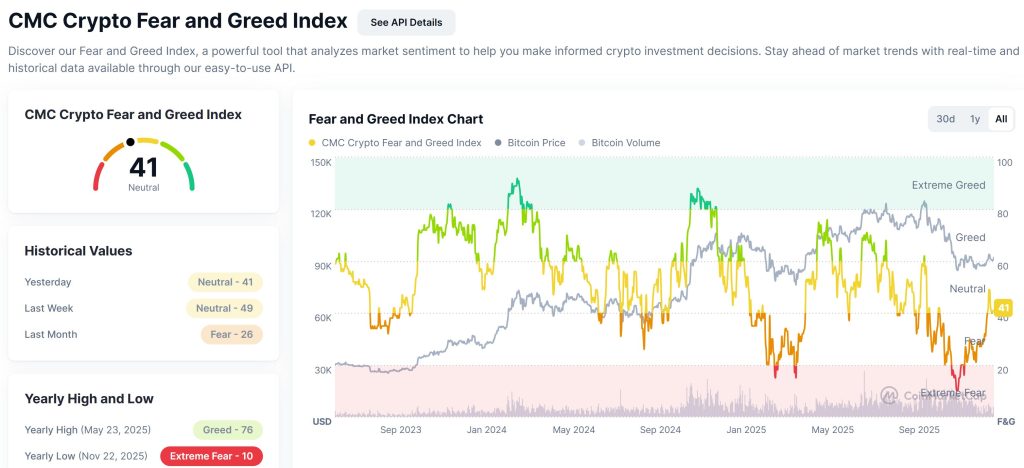

- Crypto sentiment is neutral, with the Fear & Greed Index at 41;

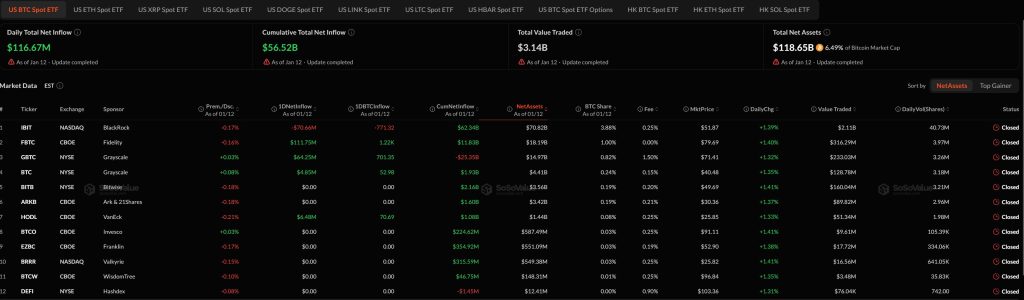

- US BTC spot ETFs saw net inflows of $116.67 million, bringing cumulative inflows to $56.52 billion;

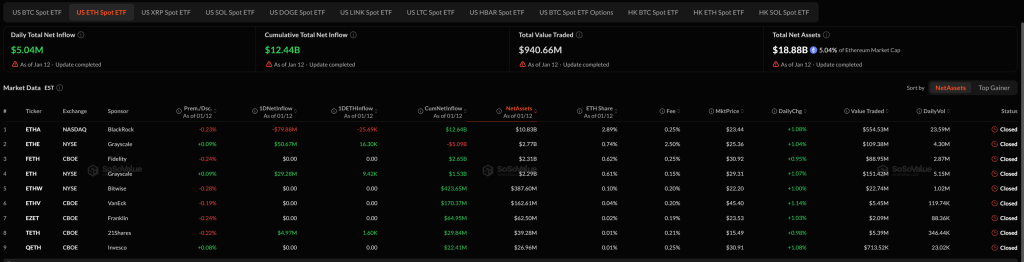

- US ETH spot ETFs saw modest inflows of $5.04 million;

- Former New York Mayor Eric Adams’ NYC Token briefly reached a market cap of $580 million before crashing 80%.

Crypto Winners and Losers

Bitcoin (BTC) is trading near $92,169, up about 1.7% in the last 24 hours, helping to support the broader market.

Ethereum (ETH) is also in positive territory, up 0.7% to around $3,136, although it remains down on a weekly basis.

Solana (SOL) was among the best performers in the top 10, climbing 3.0% to around $141.79.

It is followed by TRON (TRX)which gained 2.3%, trading near $0.299. BNB (BNB) posted a modest 0.1% increase, changing hands around $908.50.

On the other hand, XRP (XRP) is the worst performer among the major tokens, sliding 11.5% over the past seven days and trading near $2.06.

Dogecoin (DOGE) also struggled, falling 6.8% for the week to around $0.1396. Cardano (ADA) is down 5.3% over the same period, with its price currently near $0.393.

Outside the top 10, focused on privacy Monero (XMR) is the most notable gainer, surging more than 50% in the past seven days and trading around $671.61.

Hyphen (DASH) has also seen strong momentum, rising nearly 37% over the past week to around $51.08.

Among the big winners, Pirate Channel (ARRR) And Dolomite (DOLO) posted gains of more than 50%.

Meanwhile, VanEck declared 2026 a “risky” year for investors despite Bitcoin breaking its traditional four-year cycle, with CEO Jan van Eck positioning artificial intelligence, private credit and gold as attractive opportunities following late 2025 corrections.

The asset manager’s outlook for the first quarter of 2026 emphasizes unprecedented visibility on fiscal and monetary policy, marking a step change from recent years, when economic uncertainty dominated markets, and contrasting with Goldman Sachs’ forecast of a global stock market return of 11%, driven primarily by stocks rather than alternative assets.

Bitcoin Holds Near $91,000 as Global Stocks Rally and CPI Looms

Bitcoin hovered around $91,000 on Tuesday, showing little direction as traders focused on movements in global stocks and waited for further U.S. macroeconomic signals. Japan’s stock market stole the show, with the Nikkei and Topix both hitting record highs, buoyed by post-holiday catch-up buying, election speculation and a weaker yen that boosted export-heavy stocks.

Risk appetite remained broadly intact in Asia and the United States after the record close on Wall Street, although headlines surrounding a Justice Department investigation involving Federal Reserve Chairman Jerome Powell remained in the background. Cryptocurrency prices fell slightly, however, with Bitcoin, Ether and XRP all down on the day, reflecting a pause rather than a panic.

The focus now shifts squarely to US inflation data, with traders eyeing the upcoming CPI report and Fed communications as key catalysts for crypto and broader risk assets. Market watchers say Bitcoin appears stuck in a consolidation phase, with rate expectations, dollar movements and ETF flows likely to dictate the next significant move once macroeconomic data resets positioning.

Meanwhile, Matt Hougan, Bitwise’s chief investment officer, strongly pushed back against renewed concerns that Bitcoin is too volatile to consider for retirement accounts.

He called efforts to lock up assets in 401(k) plans “ridiculous” and out of step with how risk is treated elsewhere in financial markets.

Levels and events to watch next

At the time of writing on Tuesday, Bitcoin was trading near $92,200, after seeing a strong intraday rebound. The price spent much of the previous session consolidating before climbing from an intraday low near $91,100 to a session high around $92,350. The momentum has slowed slightly since then, but the price remains supported above the $92,000 level.

Over the past week, BTC has traded in a wide range of $88,500 to $94,500, reflecting the ongoing consolidation following the sharp sell-off seen in November. On a weekly basis, Bitcoin remains slightly down, with downward moves repeatedly finding buyers in the $80,000s.

A sustained close above $92,500 could open the door for a move towards $94,000, followed by a potential retest of the $96,000-$98,000 resistance zone. On the downside, failure to hold above $91,000 would expose support at $89,800, with larger pullbacks bringing up $87,500.

Ethereum is currently trading near $3,136, having recovered from earlier weakness. The token moved sideways for much of the session before plunging towards $3,080 and then rebounding sharply to reach an intraday high near $3,170. The price has since declined but remains firmly above the $3,100 level.

On a weekly basis, ETH is down around 2%, trading in a range of $2,950 to $3,300. While volatility has reduced, buyers continue to defend declines near the psychological $3,000 mark, suggesting ongoing accumulation rather than distribution.

If Ethereum manages to close above $3,180 daily, it could attempt to advance towards $3,250, followed by resistance near $3,300. A break above this zone would shift the focus towards $3,400 to $3,450. Conversely, a loss of the $3,100 support could trigger a decline towards $3,000, with further downside risk extending to $2,880.

Additionally, crypto market sentiment remains subdued, holding near neutral levels despite recent price swings. The Crypto Fear and Greed Index is currently at 41, unchanged from yesterday, placing it firmly in the neutral zone, although well below last week’s reading near 50.

The data suggests traders are cautious rather than optimistic, with risk appetite still contained after the volatility seen over the past month, when sentiment briefly dipped into fear territory.

US Bitcoin spot exchange-traded funds (ETFs) saw net inflows of $116.67 million on the last trading day, bringing cumulative net inflows to $56.52 billion. The total trading value between products reached $3.14 billion, while total net assets climbed to $118.65 billion, equivalent to approximately 6.5% of Bitcoin’s market capitalization.

The flows were concentrated in a handful of funds. Fidelity’s FBTC led inflows with $111.75 million, followed by Grayscale’s GBTC, which added $64.25 million, and VanEck’s HODL, which brought in $6.48 million. These gains helped offset continued pressure on other products, including BlackRock’s IBIT, which saw a withdrawal of $70.66 million.

US Ether spot ETFs also ended the latest session with modest net inflows of $5.04 million, bringing cumulative net inflows to around $12.44 billion. The total trading value on Ether ETFs reached approximately $940.7 million, while total net assets climbed to $18.88 billion, representing approximately 5% of Ethereum’s market capitalization.

The flows were mixed at the fund level. Grayscale’s ETHE led inflows with $50.67 million, alongside Grayscale’s ETH fund, which added $29.28 million. 21Shares’ TETH also saw a lower inflow of $4.97 million, helping to keep overall flows in positive territory. These gains were partially offset by continued ETHA outflows from BlackRock, which saw $79.88 million in redemptions that day.

Meanwhile, former New York City Mayor Eric Adams launched NYC Token, a memecoin that he says aims to counter what he describes as the rise of anti-Semitism and anti-Americanism, while promoting blockchain education.

The token’s launch was quickly overshadowed by controversy. NYC Token briefly surged to an estimated market capitalization of $580 million before crashing about 80% within minutes, amid allegations of rug pulling and extreme token centralization.

The article Why is crypto rising today? – January 13, 2026 appeared first on Cryptonews.

VanEck declares 2026 a risky year with AI, private credit and gold as key opportunities despite Bitcoin breaking its traditional four-year cycle.

VanEck declares 2026 a risky year with AI, private credit and gold as key opportunities despite Bitcoin breaking its traditional four-year cycle. Bitcoin held steady near $91,000 as Japan’s Nikkei and Topix hit record highs, with Tokyo stocks riding momentum from Wall Street and recovery hopes.

Bitcoin held steady near $91,000 as Japan’s Nikkei and Topix hit record highs, with Tokyo stocks riding momentum from Wall Street and recovery hopes. Former New York City Mayor Eric Adams launched NYC Token to combat the spread of “anti-Semitism and anti-Americanism” in the country.

Former New York City Mayor Eric Adams launched NYC Token to combat the spread of “anti-Semitism and anti-Americanism” in the country.