TLDR

- The total crypto market capitalization fell from $84 billion to $3.61 trillion after high intraday volatility, demonstrating fragile investor confidence.

- Bitcoin fell to the $108,000 support level with risks of further downside to $105,000 if selling pressure continues

- The slowdown follows October’s massive crash that wiped $370 billion off cryptocurrency valuations after Trump’s tariff announcements.

- Geopolitical tensions and ETF outflows continue to weigh on market sentiment, with traders remaining cautious after record selloffs.

The cryptocurrency market saw another decline on Wednesday, October 22, as the total market capitalization fell by more than $84 billion. This drop brought the total crypto market cap down to $3.61 trillion at press time.

Bitcoin fell to $108,057 after briefly approaching $114,000 earlier in the trading session. The leading cryptocurrency now sits at a crucial support level around $108,000.

Ethereum traded near $3,870, marking a decline of around 4-6% over the past week. Most major altcoins remained stable or saw slight losses during the same period.

The market briefly recovered during intraday trading, with total capitalization increasing by $103 billion before reversing. This strong development highlights the current fragility of investor sentiment towards digital assets.

The selloff comes as the fallout from October’s historic flash crash continues. This event wiped $370 billion off cryptocurrency valuations just hours after President Trump announced increased tariffs on Chinese imports.

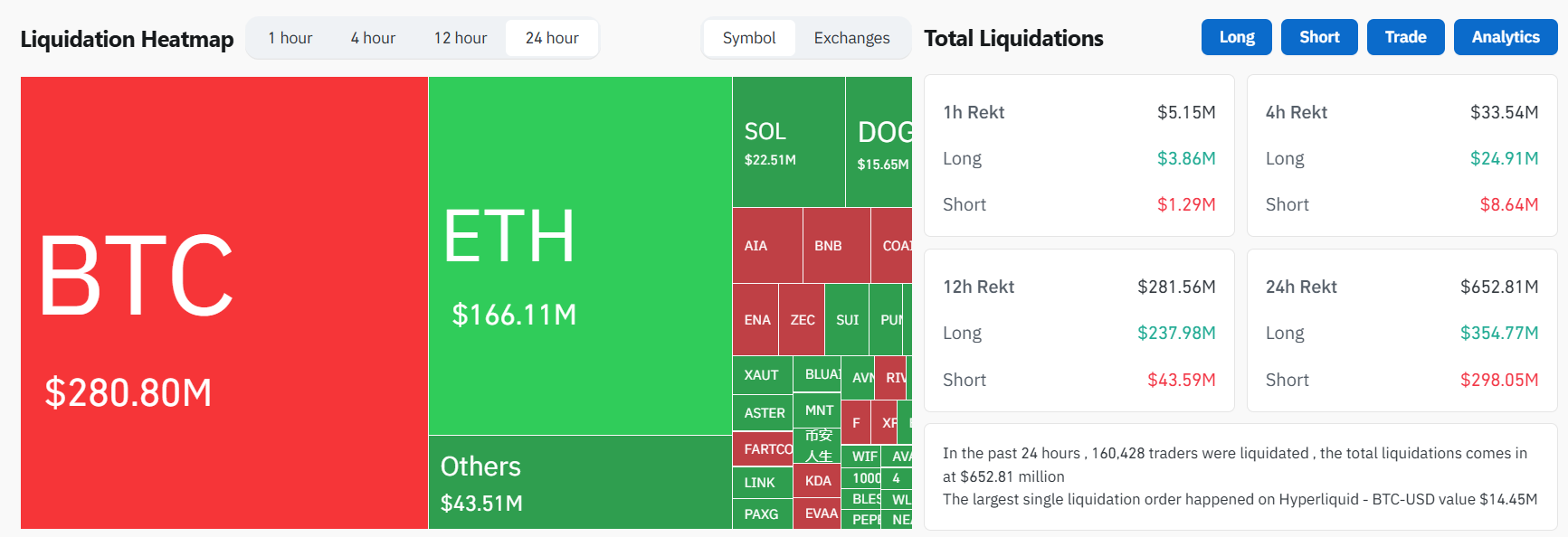

Consequences of the liquidation wave

The October crash triggered the largest single-day liquidation wave in cryptocurrency history. More than $19 billion in leveraged positions were wiped out during the event.

Trading volumes and market liquidity have struggled to recover since the massive selloff. Traders have taken a more cautious approach to the market.

Short sellers have taken advantage of Bitcoin’s recent weakness. Some large traders reportedly placed short bets exceeding $200 million in total exposure.

Bitcoin repeatedly failed to break through the resistance at the $114,000 level. These failed attempts reinforced the short-term bearish momentum of the market.

Support Levels Under Watch

If Bitcoin’s decline continues, analysts expect the price to fall as low as $105,585. A break below the $105,000 support level could trigger additional panic selling.

The total crypto market cap faces support near $3.56 trillion. A drop to this level would confirm continued downward pressure across the sector.

External pressure support

The renewed geopolitical tensions between Washington and Beijing are weighing on sentiment in risky assets. Outflows from cryptocurrency exchange-traded funds have continued over the past few sessions.

Credit concerns in global markets and uncertainty around inflation data are contributing to risk aversion. Traders are waiting for the next US Consumer Price Index report to see their direction.

British Columbia has permanently banned new crypto mining connections to its power grid to protect power resources. The decision ends prospects for new mining projects in the province.