Ethereum tries to hold the level of crucial support of $ 3,600 after a modest withdrawal of recent peaks. Despite the short -term correction, the ETH remains one of the strongest artists on the cryptography market, which has increased by more than 85% since the end of June. The bulls continue to show force, supported by weeks of sustained purchase pressure and increasing confidence of investors.

In the midst of the current uncertainty of the market, the fundamentals of Ethereum remain solid. The network has gained a major boost of legal clarity in the United States, which gives institutional actors more confidence to engage with ETH. At the same time, adoption continues to develop on a global scale, with Ethereum leading the space to tokenization of real assets (RWA) – capturing more than 80% of the total market share between chains.

Chain data also indicates a strong accumulation of major holders, indicating that intelligent money continues to bet on the long -term potential of Ethereum. Whale activity and healthy measurements on chain suggest that recent correction could simply be a consolidation phase before another higher leg.

Ethereum domination in the RWA market strengthens long -term growth

According to analyst Ted Ted, Ethereum currently has an impressive share of 83.69% of total market capitalization in the real world (RWA) by chain, highlighting its dominant position in one of the fastest sectors of the crypto. This dominant part has further solidified the role of Ethereum as a fundamental layer of the active world tokenized, in particular stablecoins, state obligations and private titles.

This trend began to accelerate in particular in April 2025, coinciding with the sharp increase in Ethereum prices and the confidence of renewed investors. The alignment of a strong price action with chain expansion in token finance reflects both the speculative interest and the long -term growth of public services.

RWAs have become a focal point for institutional interest, the stablecoins leading the charge. Analysts consider the stablescoin sector as the most likely ramp for the value of the real world in blockchain ecosystems during the next decade. Ethereum, which has long supported the largest stable supply – including USDT and USDC – continues to direct the land, alongside Tron.

However, Ethereum’s advantage lies in its integration of composibility and challenge, allowing more complex and scalable RWA infrastructure. As regulatory clarity improves and financial institutions evolve towards the emission on the chain, Ethereum is positioned to grasp even more market share.

If RWA tokenization becomes an industry of several billion dollars, as expected, the advantages and effects of Ethereum network can be crucial. The data not only supports long -term bullish accounts – he suggests that the domination of Ethereum in Rwas could be one of the key catalysts for the next major cycle.

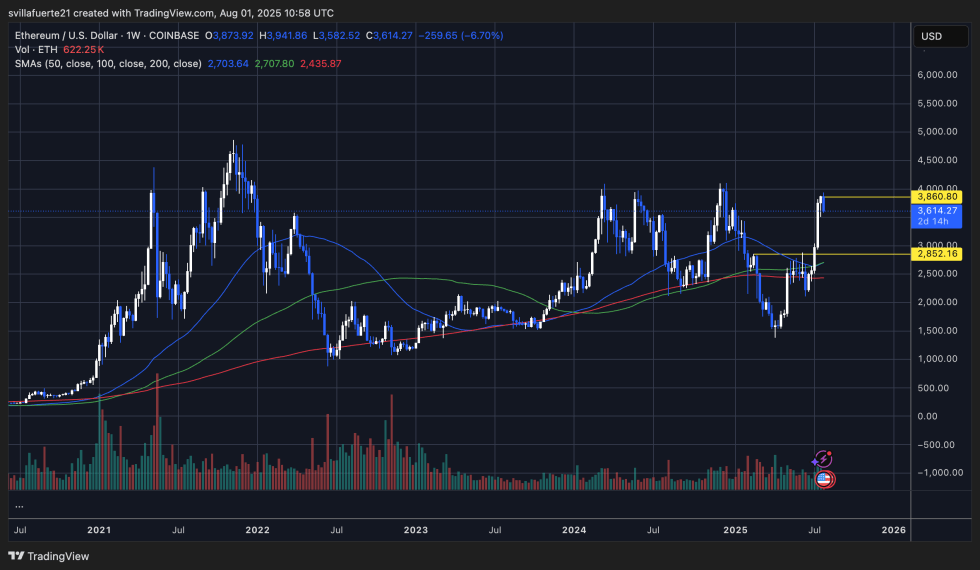

The weekly graph shows a strong escape and support to recover in the middle of the hindsight

The weekly graph of Ethereum shows a powerful movement above $ 3,000, followed by an escape around $ 3,860 before facing the resistance and a correction of 6.7% at $ 3,614. Despite the recent decline, the situation as a whole remains structurally optimistic. ETH has recovered the mobile averages of 100 weeks and 200 weeks ($ 2,707 and $ 2,435, respectively), which historically act as main levels defining trends. Keeping above these levels indicates a potential long-term trend reversal compared to the stockings of last year.

The volume increased during the break, suggesting high demand rather than low speculative purchases. The level of $ 2,852 is now the main weekly medium to monitor – a resistance area for several months – which strengthens its meaning. If Eth holds this support for the next Retest, the Bulls could target another movement around $ 4,000.

A weekly fence greater than $ 3,8860 would mark a new summit for the year and would open the way to the withdrawal of the area from $ 4,500 to $ 5,000 for the last time at the end of 2021. However, the fact of not recovering the fork of $ 3,850 could quickly lead to a higher withdrawal or lateral consolidation.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.