This article is also available in Spanish.

As 2024 draws to a close, Ethereum price fluctuations are being closely watched. The cryptocurrency’s trajectory is heavily influenced by key resistance and support levels, as indicated by recent analysis from crypto experts, which suggests a cautiously optimistic outlook.

Related reading

Important Price Levels to Watch

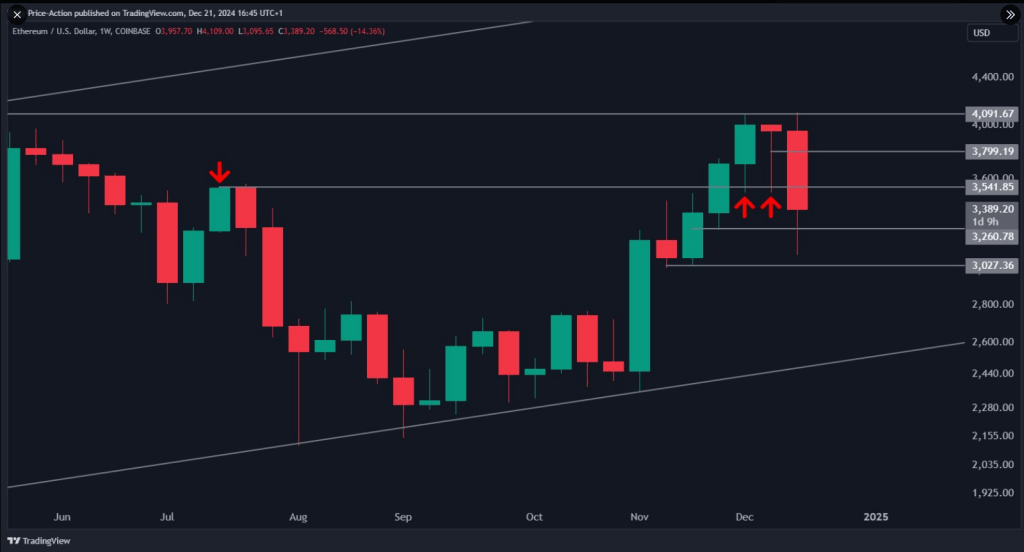

Analyzing cryptocurrencies, Justin Bennett highlighted the importance of Ethereum regaining the $3,540 level in the weekly time frame of December 22. This price range is considered necessary to show a potential market shift towards optimism.

If Ethereum fails to break this barrier, it risks slipping below the important $3,000 support zone, leading to a decline towards $2,600. For investors and speculators alike, a drop to this level would be costly.

As optimistic as I am with the overall setup through 2025, buyers still have work to do.

For example, $ETH needs to reclaim $3,540 on the weekly timeframe to look bullish next week.

Buyers have 33 hours to do so.#Ethereum pic.twitter.com/cAChCbJxjd

– Justin Bennett (@JustinBennettFX) December 21, 2024

Market Sentiment and Analyst Forecasts

Further bolstering the optimism surrounding Ethereum is the analysis from Titan of Crypto, which used the Ichimoku cloud approach to predict a likely recovery.

The analyst noted that Ethereum has retested some critical levels, which gives the impression that the current correction cycle is coming to an end. The strength of Kumo Cloud’s support line indicates that Ethereum could well provide a base for higher moves if it can maintain existing levels.

Whales accelerate their accumulation

Meanwhile, Ethereum whales increased their holdings and amassed around 340,000 ETH, worth over $1 billion, in just a few days. This increase in accumulation shows that large investors are becoming more confident in the prospects of the altcoin.

Ethereum Whales Bought $1B worth of ETH in the Last 96 Hours – Details

– José JM (@CryptoJoseJM) December 22, 2024

Additionally, Ethereum spot ETFs have generated inflows of over $2 billion since their introduction to the US market, demonstrating the growing interest in these instruments. If regulators allow staking of returns within these funds, analysts predict this trend could overtake Bitcoin ETFs by 2025.

Ethereum Price Prediction

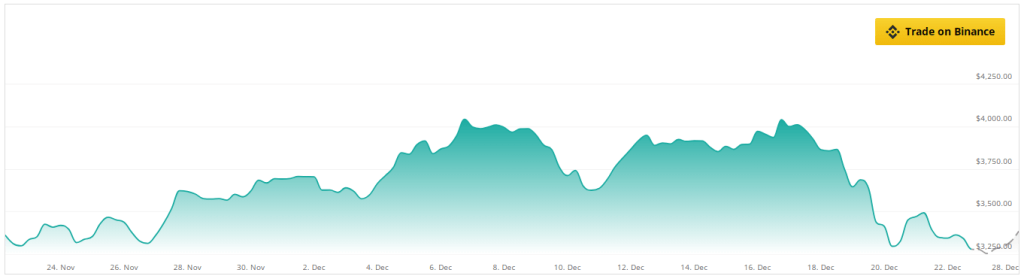

At the time of writing, Ether was trading at $3,330, down 0.7% and down 15.7% on the daily and weekly time frames, according to Coingecko data.

Based on current Ethereum market developments, there will likely be a positive upward trend over the next week, despite Ether numbers flashing red in the charts.

Analysts are hopeful about its chances of recovery, even though the stock is selling at a 21% discount to what they think it will be worth a month from now.

Source: CoinCheckup

A potential breakout that could test critical resistance levels is indicated by technical indicators such as the Relative Strength Index (RSI) and moving averages.

Ethereum is expected to experience a robust development trajectory in the medium to long term, with a 35% price increase over the next three months and a remarkable 100% growth within a year, according to projections.

Featured image of DALL-E, chart by TradingView