On January 1, Vitalik Buterin announced a New Year’s resolution for the blockchain he designed in 2013. It’s time, he said, for Ethereum to step up and fulfill its original mission: “To build the global computer that serves as the central infrastructure for a freer and more open Internet.” »

Buterin’s message is timely. For over a decade now, Ethereum has offered the tantalizing promise of a global computer, accessible to everyone, that can be used to create decentralized alternatives to the data-hungry monopolies of Big Tech. Blockchain popularized smart contracts and was a springboard for thousands of projects backed by billions of dollars. It also spawned legions of mostly short-lived imitators.

Despite all this, the promise of Ethereum still seems to be on the horizon. In recent years, blockchain has become like that hotshot sports hopeful who can’t quite crack it in the big leagues. Instead of evolving into a popular world computer, Ethereum still feels like a subculture where insider cliques create esoteric applications for each other. In response, many in the crypto world began betting on other horses like Solana, which promised to deliver practical results.

Ironically, Ethereum’s problem is its idealism. Blockchain has a core community that passionately believes in decentralization and distrusts anything resembling formal authority. This includes Buterin, who stepped away from its creation several years ago, preferring to let Ethereum find its own path.

This is all admirable, especially unlike many newcomers to the crypto scene, whose first and only concern is making money. Unfortunately, this has also led Ethereum developers to procrastinate over obvious problems, including congestion and high gas fees. To be fair, blockchain has made some important fixes, but only after allowing piggyback chains, known as layer 2, to siphon off large amounts of revenue and make the crypto landscape painfully complicated.

But today, change could be in the air. Over the past two years, BlackRock and JPMorgan Chase have launched tokenized assets that sit directly on the main Ethereum blockchain. This is a testament to how Ethereum remains the gold standard for security and portends a future where it will be the backbone of global finance. Tokenized transactions also legitimize Ethereum’s claim to be a universal computer and could spur widespread adoption of other decentralized applications for social media, identity, and more.

However, for this to happen, the Ethereum community will need Buterin’s continued leadership. That’s why his New Year’s message is a welcome development. The article reinforces the primacy of decentralization as Ethereum’s core value: “We build decentralized applications. Applications that operate without fraud, censorship, or third-party interference. Applications that pass the exit test: they continue to function even if the original developers disappear.”

But he also gave some pragmatic advice to the community looking to build this decentralized future: get going, already.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

The Trump drop is coming: Another Trump token is on the way as Truth Social announced an upcoming drop to its shareholders via Crypto.com. The company added that the token would not be transferable and “could not be exchanged for cash,” but could become redeemable for Trump Media discounts. (FT)

The misery of Memecoins: In a year where silver outperformed all other assets, Bitcoin saw a 5% decline in 2025. But the biggest losers of 2026 were memecoins with Dogwifhat down 91%, $TRUMP down 93% and Milei’s $LIBRA down 99%. (WSJ)

Better late than never: PWC’s US head, echoing previous statements from its Big 4 peers, says the consultancy has decided to “lean in” to crypto in light of the new regulatory environment. The firm actively provides audits and advice to its clients. (FT)

Bitcoin bounces back: The crypto market got off to a strong start in 2026, as Bitcoin soared over $93,000 and altcoins posted gains even as the economic impact of events in Venezuela remains uncertain. (Bloomberg)

Count the coins: In a key development in corporate accounting, standards body FASB will formally explore whether companies can treat stablecoins as cash equivalents. (WSJ)

MAIN CHARACTER OF THE WEEK

@cipherstein

Ilya Lichtenstein, the mastermind behind the multibillion-dollar Bitfinex hack, is the latest crypto criminal to walk free. He now faces a fate many would consider worse than prison: resuming his domestic life with his rapper wife Razzlekhan.

EVEN WHERE

@lopp

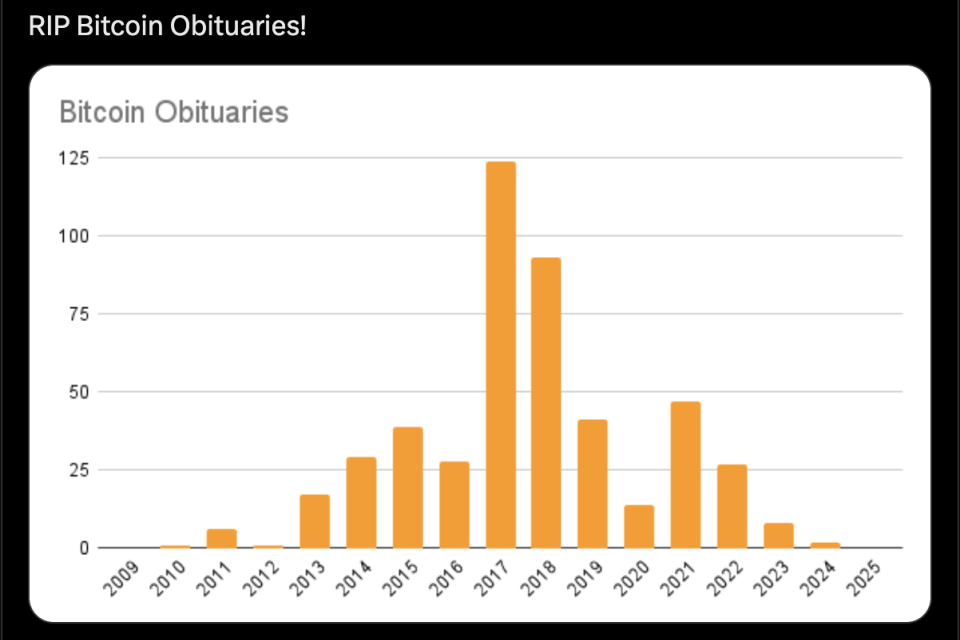

It was once fashionable for journalists to take advantage of falling prices to write sneering articles predicting the demise of Bitcoin. These “Bitcoin obituaries” persisted long after the viability of the currency became clear, but now appear to have disappeared entirely.