Ethereum continues to trade below the critical $3,000 level as selling pressure intensifies and fear dominates sentiment in the crypto market. The broader downturn has pushed ETH nearly 40% below its August all-time high, raising concerns that the asset is entering a prolonged bearish phase. Analysts who were once confident the recovery would continue are now changing their tune, warning that market structure, volatility and liquidity conditions are starting to resemble bear market behavior at an early stage.

Related reading

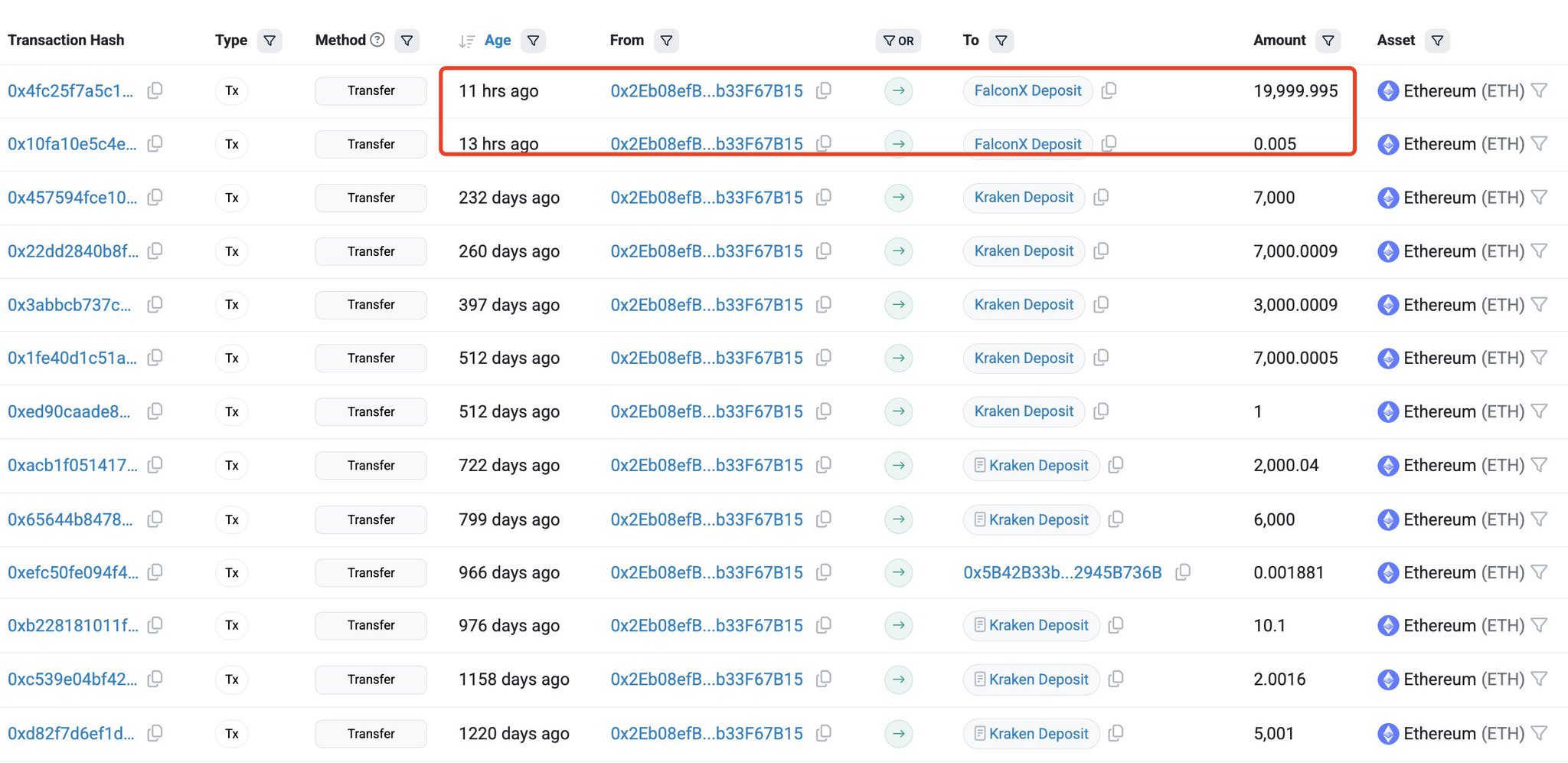

At the same time, investor confidence is being further tested by new on-chain activity showing large holders reducing their exposure. According to Lookonchain data, an Ethereum ICO participant sold an additional 20,000 ETH, worth approximately $58.14 million, through FalconX just a few hours ago.

With selling pressure accelerating, derivatives sentiment weakening, and long-term holders beginning to reduce their positions, Ethereum now finds itself at a pivotal moment. The bulls need to reclaim the $3,000 zone to stabilize their momentum, while the bears say a deeper correction could occur if support continues to erode.

ICO whale sale increases pressure as Ethereum awaits direction

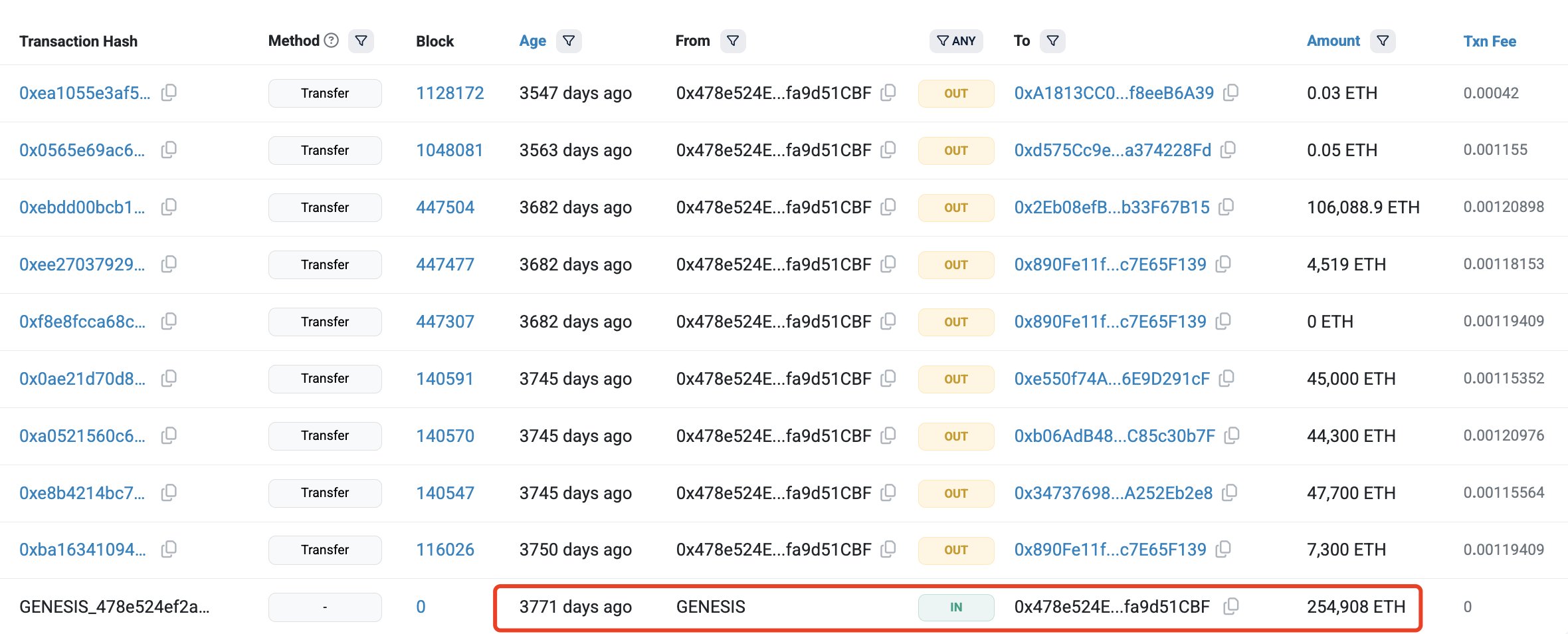

According to Lookonchain, the wallet behind the latest sale – identified as the address 0x2eb0 – is no ordinary holder. This Ethereum OG received 254,908 ETH during the ICO, paying only $79,000 at the time. At today’s prices, this allocation amounts to approximately $757 million, highlighting the scale of unrealized gains still held by early participants. The recent sale of 20,000 ETH suggests that even long-time holders with substantial profit reserves are starting to dump coins, strengthening the already fragile market environment.

This sales activity is particularly impactful given current sentiment. Ethereum has already fallen sharply from its highs, leverage has reduced in derivatives markets, and retail confidence has weakened. When an early participant whose costs are close to zero begins to distribute, this sends a psychological signal that further declines are possible. Still, some analysts say these selloffs may simply represent portfolio turnover rather than a long-term bearish stance.

The next few days will be decisive as investors will monitor whether Ethereum can stabilize and rebound or whether selling pressure accelerates. A recovery above $3,000 could reignite optimism and reignite momentum, while continued weakness risks confirming a deeper downtrend for both ETH and the market as a whole.

Related reading

Breakdown, weak structure and fragile rebound attempt

Ethereum’s weekly chart reveals a clear deterioration in the trend structure following the sharp rejection from the $4,400 region and subsequent break below the $3,200 support zone. The sell-off pushed ETH towards the mid-$2,700s before a modest rebound, but the price remains below major moving averages, signaling that momentum continues to favor sellers.

The 50-week moving average has reversed, while the 100- and 200-week moving averages now sit above it, forming layered resistance that could limit any near-term recovery attempts.

Related reading

Volume during the decline increased noticeably, indicating active distribution rather than passive drift. The most recent candle shows a slight bounce, but without significant volume follow-through, suggesting hesitation and lack of conviction on the part of buyers.

For Ethereum to regain a bullish structure, it is essential to reclaim the $3,000-$3,200 zone, as this zone acted as critical support during previous phases of the cycle and now threatens to turn into resistance.

Featured image from ChatGPT, chart from TradingView.com