Ethereum entered a volatile phase after having broken its peaks of all time in 2021 last week, causing both excitation and caution through the market. After overvoltage, ETH retraced and tested critical demand levels, where buyers intervened to defend support. Bulls show resilience, analysts pointing out the possibility of Ethereum exceeding $ 5,000 in the short term.

However, the risks of a deeper correction weigh heavily, fueling uncertainty among traders and investors. Fear begins to slip into the feeling, because some wonder if the Ethereum rally is durable or if another decline is on the horizon.

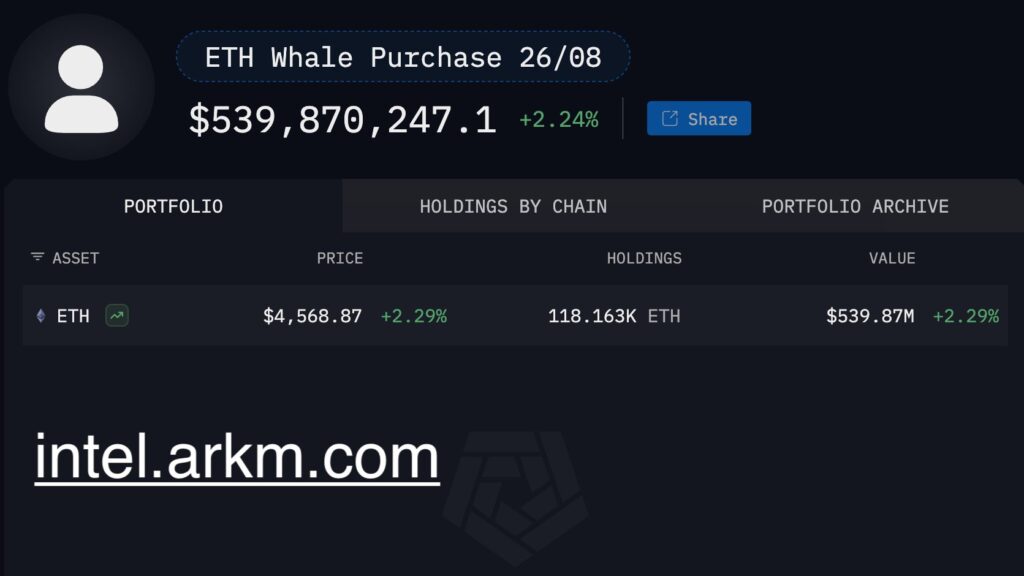

However, in this environment, an undeniable trend stands out: whales accumulate. Arkham Intelligence revealed that nine whale addresses collectively bought around $ 450 million from Ethereum only yesterday, signaling the confidence of the largest players on the market. This wave of accumulation highlights the way in which deep pocket investors benefit from retractions, potentially preparing for the next step up.

Ethereum whales report confidence

According to Arkham Intelligence, Ethereum whales make decisive movements that could shape the next phase of the market. The data show that nine massive addresses have collectively bought $ 456.8 million in ETH in a single day. Among these, five portfolios have received entries directly from Bitgo, a leading institutional guardian, while the other four have acquired their positions via an on-the-counter office of Galaxy Digital (OTC). These transactions not only reflect the individual confidence of whales, but also the growing role of institutional quality platforms in the facilitation of large -scale Ethereum accumulation.

This increase in whale activity highlights a critical market dynamic: deep pocket investors are positioned for what could be the next higher step in the Ethereum price cycle. Historically, the accumulation of whales during periods of volatility preceded upward importance, offering a solid base for bullish stories. The ETH already testing crucial demand zones after its breakup over the summits of all time in 2021, these entries can help stabilize prices and create momentum to an unexplored territory.

Beyond whales, public companies also enter the image. Companies like Bitmin and Sharplink Gaming have recently disclosed Ethereum posts, more validating the role of ETH as an institutional quality. Their involvement echoes what Bitcoin lived in its first phase of enterprise adoption – when public enterprises added BTC to their balance sheets, fueling strong market confidence.

Overall, the combination of the accumulation of whales, institutional purchases in OTC and the adoption of public enterprises depicts a clear image: confidence in the long -term trajectory of Ethereum is strengthening. Although short -term risks remain, these trends strengthen a bullish file so that the ETH moves to the discovery of prices and potentially exceeds $ 5,000. The market looks closely, but whales and institutions seem to cause the charge.

Ethereum is under the name of Bulls Eye $ 5,000

Ethereum is negotiated about $ 4,592 after having bounced after a net retirement on local summits nearly $ 4,850. The 4-hour graph shows that ETH takes up force above the 50 days and 100 days mobile averages, reporting that buyers are coming back to defend the key levels. This decision restores confidence in the short -term trend, even if volatility maintains traders on board.

The wider image remains favorable. With the 200 -day mobile average at $ 4,119, Ethereum has a comfortable cushion that highlights its resilience despite recent fluctuations. Hold over the faster averages stabilizes not only the momentum, but also prepares the ground for another attempt at resistance. The upcoming critical barrier is at $ 4,800, where the sellers have previously capped the rally. A decisive breakdown could open the way to $ 5,000, an important step which, according to analysts, would feed a new enthusiasm and potentially launch a new stage of price discovery.

However, the risks of another decline persist. A drop below $ 4,400 could return ETH to the request area of $ 4,200, where an earlier purchase pressure has emerged. For the moment, however, the feeling is cautiously leaning up. The whales continue to accumulate, the techniques remain constructive and Ethereum seems ready to test higher levels if the momentum takes place.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.