Main to remember

- Franklin filed an S-1 with the SEC to launch an ETF focused on XRP.

- A final decision is expected by October 2025 for most documents.

Share this article

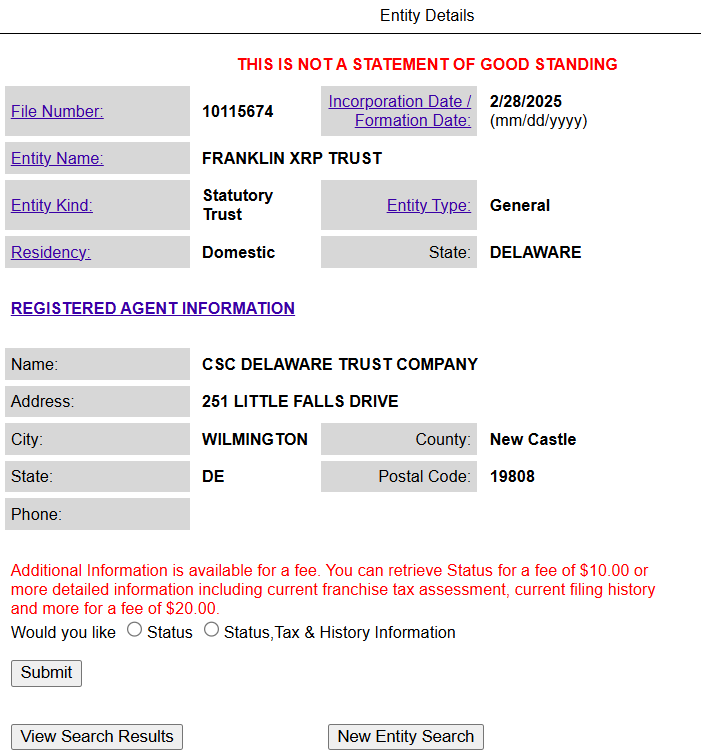

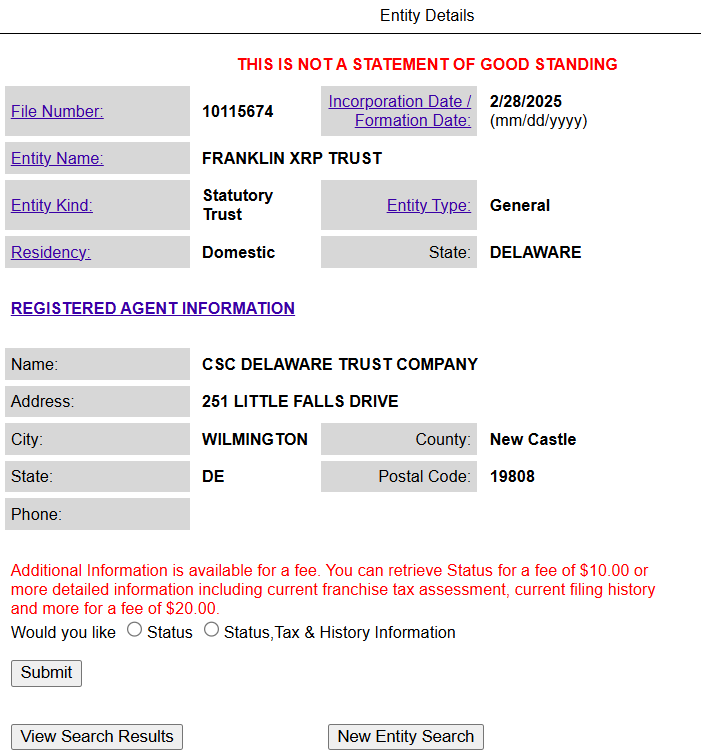

Franklin Holdings, the parent company of the world investment company Franklin Templeton, has filed an S-1 registration form to the SEC to launch an XRP ETF. The file comes after the company recorded Franklin XRP Trust in Delaware on February 28.

The new deposit with the SEC officially places the entity among an increasing number of asset managers vocally for an XRP ETF, including Birlet, 21Shares, Canary Capital, Grayscale and Wisdomtree.

The proposed fund, which would be negotiated on the BZX Exchange CBOE, aims to provide investors with an exposure to XRP, currently the fourth greatest cryptographic asset by market capitalization. The symbol of the ETF ticker has not yet been determined, according to a file on Tuesday.

Coinbase Custody would serve as a goalkeeper for the XRP holders of the fund, while Coinbase would serve as a first broker. CSC Delaware Trust Company would serve as a trustee.

The actions would be offered continuously with net value of assets, with only authorized participants capable of creating or exchanging creation units. The fund would use the reference rate CF CF CF CF XRP-Dollar to determine its net asset value.

Franklin Holdings will sponsor the fund and agreed to pay most ordinary operating expenses in exchange for a sponsor fees. The trust is structured as an emerging growth company under the jobs law.

The deposit marks the last attempt to launch an ETF Crypto Spot following previous approvals of Bitcoin and ETF ETF. The SEC must examine and approve the deposit before the fund can start trade.

The SEC has recognized several ETF XRP deposits in recent weeks, starting with the XRP ETF application of Graycale on February 14, by launching a 240 -day exam period.

It was also the first time that the SEC has responded to a request to launch an investment product which contains XRP directly, the cryptographic asset which is still under regulatory control due to the continuous legal battle of the SEC with Ripple Labs during its classification as security

Other deposits, including those of Wisdomtree, Canary Capital and Coinshares, have also been officially accepted for examination. These deposits are now included in the public comments phase, which is part of the dry examination process.

Share this article