The Hedera Hashgraph token extended its decline on Tuesday while investors in crypto and shares remained on the sidelines before the announcement of the Federal Reserve.

Hedera Hashgraph (Hbar) has dropped for four consecutive days, reaching its lowest level since April 22. He dropped 15% compared to his highest point last week.

Hbar has dropped while most of the cryptocurrencies withdrew, their market capitalization from more than 3 dollars of dollars last week to 2.9 billions of dollars today. The main American indices such as Dow Jones and S&P 500 fell by more than 0.50%.

This price action reflects the prudence of market players before the decision of interest rates of the federal reserve. Economists are largely expecting the central bank holding stable rates at 4.50% because it awaits new inflation data. Any signal of a drop in future rates would probably serve as bullish catalyst for Hbar and the wider cryptography market.

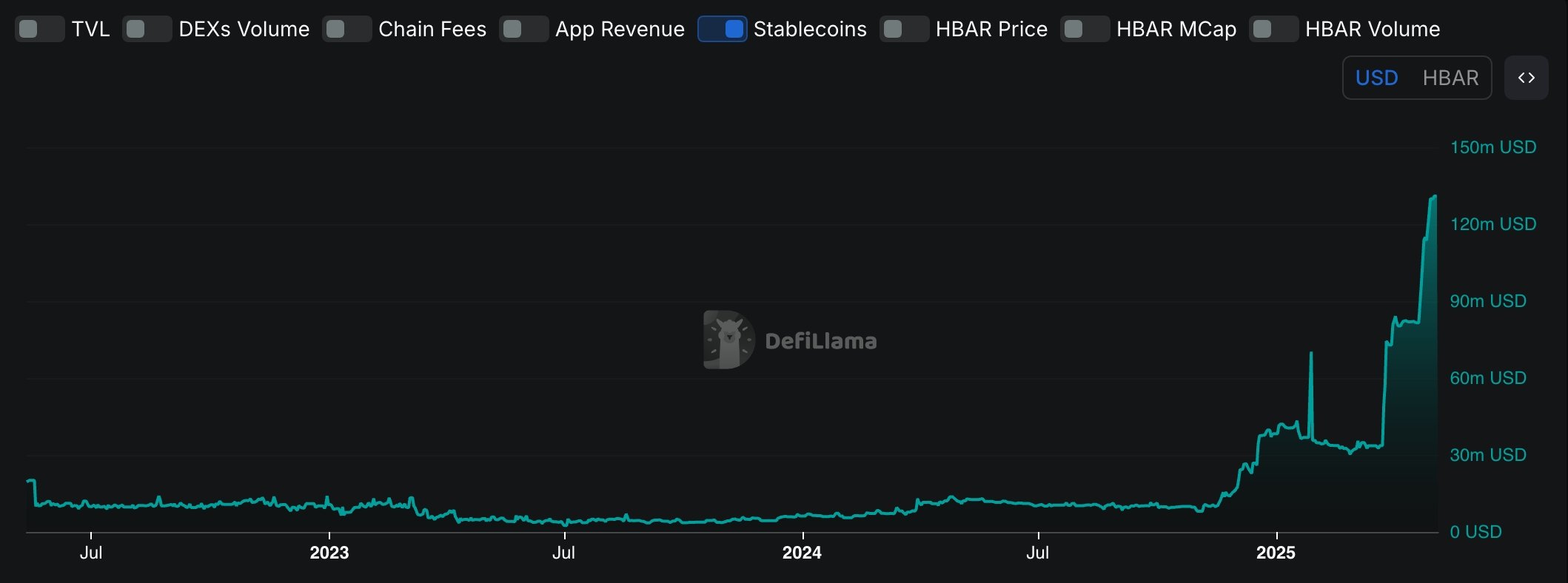

There are signs that the activity in the Hedera hash chain increases. The DEFI LLAMA data show that the market capitalization of the stable of the chain has reached a record summit of $ 130 million, a strong increase in the level of the year of $ 37 million. Circle’s USD Coin (USDC) has a market share of 99.8% in the Hedera chain. This increase is a robust sign in the network.

Another potential catalyst for Hbar is the next round table to token in the dry on May 12, which will showcase representatives of large companies such as Franklin Templeton, Blackrock and Investco. Reunion will focus on regulating token assets.

Hedera has become one of the best channels in the real asset tokenization industry. For example, he joined Tokeny Solutions last week. Tokeny provides an onchain operating system for the tokenization of compliant assets.

Hbar crypto price predicted

On the daily graphic, Hbar rebounded on April 9, moving above the upper side of a falling corner model. He then reached a maximum of 0.2020, which aligned with the exponential mobile average of 100 days.

The bars of the brilliant oscillator pointed out and are about to cross the zero line. In addition, the relative resistance index formed a double sleep model at 61.6, a sign that it is about to lower more.

In addition, the MacD lines have made a lowered crossroads. Together, these signals suggest that Hbar can continue to decrease, sellers aimed at the hollow of the year of the start of the year of 0.1250. If it is reached, this level would form a double -bottomed model, a potential reversal configuration.