Join our Telegram channel to stay up to date with the latest news

The Nasdaq International Securities Exchange (ISE) has filed a proposal with the U.S. Securities and Exchange Commission (SEC) to increase position limits for options on BlackRock’s iShares Bitcoin Trust (IBIT).

In a Federal Register NoticeThe exchange requested that restrictions on position sizes be increased from 250,000 contracts per side to one million. This would place the US spot Bitcoin ETF (exchange-traded fund) in the same liquidity tier as major global equity benchmarks such as iShares MSCI Emerging Markets (EEM) and iShares China Large-Cap ETF (FXI).

The request to increase the limit to one million contracts follows Nasdaq’s request in January to raise the cap from 25,000 to 250,000, with IBIT well above the minimum trading volume of 100 million shares to qualify.

The proposal also comes as BlackRock’s IBIT has become the largest venue of open interest in Bitcoin options, surpassing even Deribit.

Good catch.. new proposal to increase position limits on IBIT options to 1 million contracts. They just raised the limit to 250,000 (from 25,000) in July. $IBIT is now the world’s largest Bitcoin options market by open interest.

– Eric Balchunas (@EricBalchunas) November 26, 2025

The SEC is not seeking public comment on the rule change.

Nasdaq ISE says current IBIT limits restrict market makers and institutional desks

Position limits exist to prevent an investor from controlling too many options contracts on the same stock, thereby reducing the risk of manipulation that could impact stock prices.

However, ISE said IBIT has seen strong and accelerating options volumes throughout this year, and added that the existing cap now restricts market makers and institutional desks that rely on options and yield hedging strategies.

In its Federal Register notice, the exchange said it “expects continued growth in options volume in IBIT as opportunities for investors to participate in the options market increase and evolve.”

In its filing, ISE included a detailed analysis of several IBIT market statistics such as its capitalization, average daily volume and the liquidity of ETFs that already support million contract limits.

Regarding the risk of market manipulation, ISE also noted that even a fully exercised million contract position would only equate to around 7.5% of the IBIT’s total float. This also represents only about 0.284% of all Bitcoin in existence. ISE then argued that this scale presented little risk of market disruption.

In addition to the request for increased limits on position sizes for IBIT, ISE is also seeking to remove position and exercise limits for physically settled FLEX IBIT options. This would align options with commodity-based ETFs such as SPDR Gold Trust (GLD).

FLEX contracts are popular among large funds that use these instruments for customized hedges and structured exposures.

JPMorgan offers investors a chance to make big profits with IBIT

IBIT has become a popular way for traditional investors to gain exposure to cryptocurrencies through regulated investment products. Although there are other US spot Bitcoin ETFs in the market, IBIT is the largest in terms of cumulative inflows.

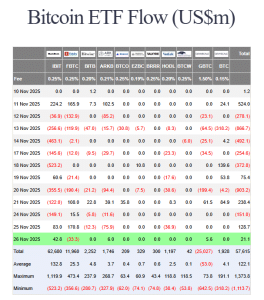

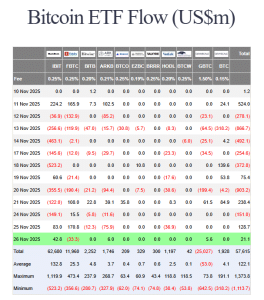

Data from Farside Investors shows that IBIT has seen total inflows of $62.680 billion since its launch in early 2024. The second largest fund in this regard is Fidelity’s FBTC with $11.960 billion in cumulative inflows.

Earlier this week, Wall Street banking giant JPMorgan filed an SEC prospectus for a structured note that allows investors to bet on the future price of Bitcoin using IBIT.

The instrument proposed by JPMorgan will set a specific price level for BlackRock’s IBIT fund next month. In approximately a year, if IBIT trades at or above the set price, the notes will be automatically recalled. Investors will then also benefit from a guaranteed minimum return of 16%.

However, if the IBIT price is lower than the fixed price one year from the setting of the reference price next month, the bonds will not be called. Participating investors will then have to extend their investment until 2028.

If IBIT exceeds the next price set by JPMorgan by the end of 2028, investors will earn 1.5x on their investment with no cap. This means that if the price of Bitcoin increases in 2028, investors will be able to get a significant return.

JPMorgan will also offer investors 30% downside protection through 2028.

In the last trading session, the price of IBIT jumped more than 2%, according to data from Google Finance watch.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news