- Popcat won 9.08% in 24 hours on daily cards.

- The bullish momentum is built with a bullish crossover on RSI and Stoch.

After falling from a local summit of $ 0.41 to a minimum of $ 0.29, Popcat (Popcat) successfully defended the support of $ 0.30 and rebounded.

Insofar as Popcat attempts an escape from the descending channel after having recorded gains for two consecutive days, reaching a summit of $ 0.339.

Popcat buyers are back

To date, Popcat was negotiated at $ 0.339, marking an increase of 9.08% in the last 24 hours. During the same period, the memecoin trading volume jumped 55% to 45.39 million dollars.

An increase in prices accompanied by a volume reflects an increasing demand for an asset, buyers returning mainly on the market. As such, in the past 24 hours, popcat buyers have accumulated more than 8 million, according to Coanyze data.

Source: Coanyze

During the current purchase frenzy, the sellers were sidelined because the same displays a positive delta of 700,000 tokens.

This growing demand is particularly obvious in the derivative market, where investors are strategically positioning themselves before the next decision.

In the term contract market, the open interests of Popcat jumped 6.69%, reaching $ 135.69 million, which suggests that traders actively enter long and short positions.

Source: Coanyze

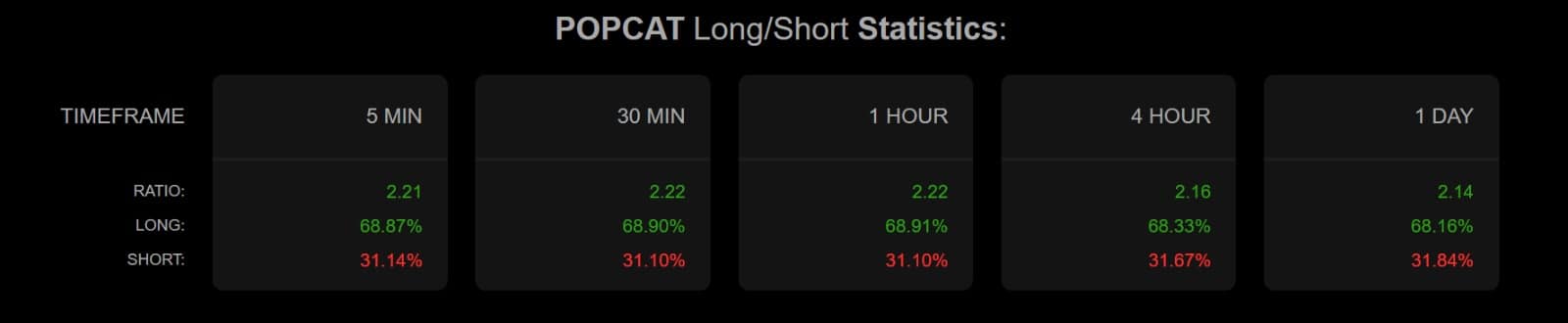

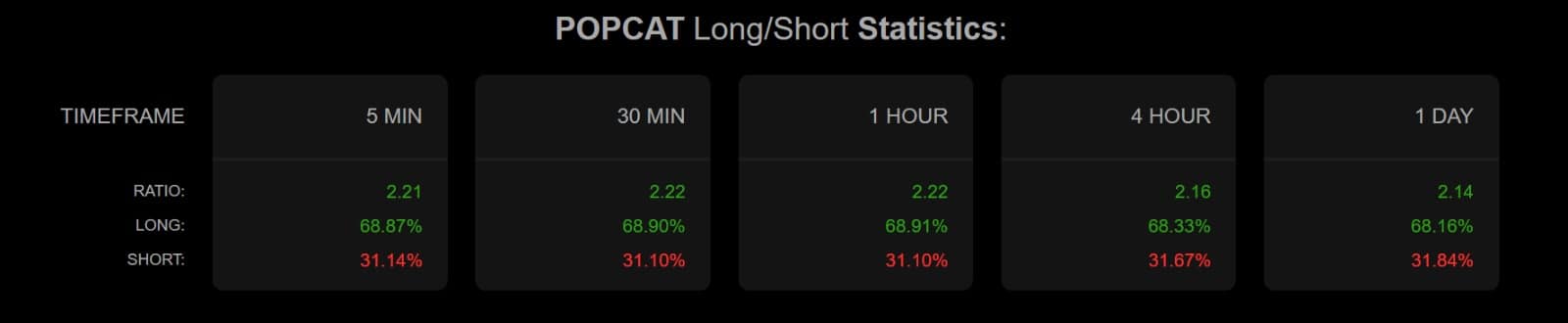

To assess the feeling of investors, we examine the popcat financing rate (FR) and the long / short ratio.

At the time of the press, the FR of Popcat remained positive in all the big exchanges and held this way in the last four days.

An always positive FR generally signals a bullish feeling on the term market, traders expecting new price gains. This perspective is supported by long / short ratio data, which show that long positions continue to dominate.

Source: Coanyze

According to Coanyze data, Longe represents 68.1% of term contracts, with short films representing 31% of the total. When long dominate, this implies that most participants are optimistic and expect prices to increase in the short term.

Can popcat support recent gains to break?

Ambcryptto’s analysis shows that the bullish momentum is gradually gaining for Popcat. Directional Momentum indicators suggest that the same tendency of the same is built.

In particular, the Popcat Stoch RSI has made a bullish crossover in the last 24 hours. This crossover signals the strengthening of the momentum, the token starting to record higher fences.

Source: tradingView

The recent bullish crossover on the medal RSI strengthens the ascending momentum of the token, reporting a strong demand from buyers.

The current market conditions reflect not only the bullish feeling, but also the potential of continuous gains. If this momentum is maintained, Popcat could test the resistance at $ 0.3712.

However, renewed sales pressure, especially after two days of earnings, could reverse this trend. A decline can once again lead to the price below the support level of $ 0.30.