Fidelity just placed Solana on one of Wall Street’s biggest brokerage menus, but some traders see reason to be cautious – here’s Solana’s price prediction.

Since October 23, Fidelity do Solana (SOL) available to customers on its crypto platforms.

Fidelity added Solana to its cryptocurrency lineup on October 23, 2025, expanding its list of supported assets to Bitcoin, Ethereum, and Litecoin.

Fidelity Digital Assets® now supports @solana for custody and trade.

Probably nothing.

SOL season.

– Teddy Fusaro (@teddyfuse) October 23, 2025

EXPLORE: The 12+ Hottest Cryptocurrency Presales to Buy Now

Could Fidelity’s support push Solana into a more stable market phase?

The company continues to promote its institutional standards, such as audited custody, insurance coverage and controlled settlement mechanisms, while building trust between professional and retail clients.

This time coincides with the growing number of Solana in the tokenization and liquidity markets.

The rapid pace of trading and growing number of developers have kept the network in the spotlight, even as market analysts note that derivatives statistics point to a growing number of leveraged bets.

Some still doubt that the history of Solana network outages is one of the main risk factors.

In the meantime, it is clear that Fidelity’s introduction of SOL constitutes another step towards mainstream recognition.

The relationship between investor confidence and the market, as well as the project’s history of high adoption and volatility, will determine whether Solana can continue its recent rally.

The announcement saw Solana trading at almost $190 on Friday.

The new initial listing makes trading accessible to all of Fidelity’s retail, IRA, wealth and institutional platforms, placing SOL in the same category as the rest of the top cryptocurrencies.

EXPLORE: Next 1000X Crypto – Here are 10+ crypto tokens that can hit 1000x this year

Solana Price Prediction: Is Solana Price Consolidation a Sign of Strength or a Pause Before a Move Down?

According to CoinGecko dataSolana changed hands between $189 and $191 in the last 24 hours, with a market cap of around $104 billion. The price increased by approximately 5.5% following the listing.

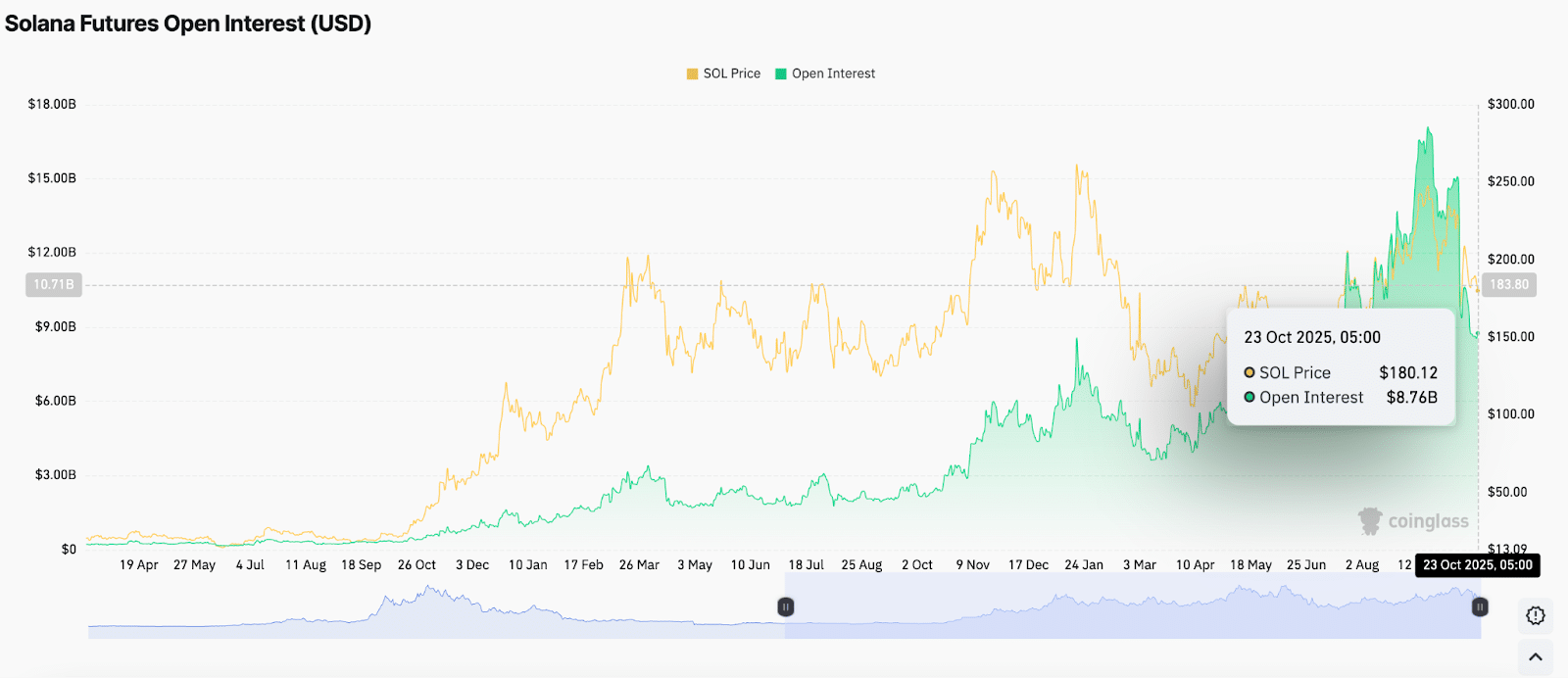

CoinGlass reported an open interest of just under $9 billion and a daily futures volume of more than $20 billion, reflecting a sharp increase in leverage activity.

(Source: Coinglass)

Analysts said the rise indicated traders were positioning around the announcement rather than a sustained breakout.

Crypto Analyst Daan Crypto note This volatility has eased since the sharp move on October 10, with the price now compressing between key support between $170 and $175 and resistance near $195 and $200.

For now, Solana’s near-term trend depends on whether it can hold above support or face further selling near the upper band.

According to Daan’s latest chart, Solana (SOL) continues to trade around its 200-day moving average (MA) and exponential moving average (EMA), two indicators that often define long-term momentum.

$ SOL Slowly moving along its daily 200MA/EMA.

Lower highs and lower lows with price compression. This is generally what we see after a major movement like that of October 10.

Volatility slowly decreases as the market finds equilibrium. From there you can search for the next one… pic.twitter.com/KJmJDC613y

– Daan Crypto Trading (@DaanCrypto) October 23, 2025

The price pattern features lower highs and lower lows, indicating compression as volatility eases after prior gains.

Recent candles suggest that SOL is attempting to stabilize near the $175-$180 zone, where the 200-day MA has repeatedly acted as key support.

This range has held several times this month, marking a short-term base.

Daan stressed that Solana “needs to hold onto this $170-$175 area as support,” noting that a breakdown below could trigger further downward pressure.

On the upside, resistance remains strong around $195-200 near the 200-day EMA and the neckline of what appears to be a small double bottom pattern.

A clear break above this level could open the way towards $210-215, an area that already saw heavy selling earlier in October.

Trading volumes have eased in recent sessions, consistent with Daan’s note that volatility is cooling as Solana’s price balances.

For the moment, Solana is stuck in a neutral zone. Its long-term moving averages are flattening after months of steady gains, showing momentum has stalled.

The next key move, a break above $200 or a drop below $175, will likely set the tone for what comes next: a push to new highs or a deeper pullback.

EXPLORE: Now that the Bull Run is dead, will Powell make further rate cuts?

Join the 99Bitcoins News Discord here for the latest market updates

Post-Solana Price Prediction: Is the Market Overreacting to Fidelity’s Solana Expansion? appeared first on 99Bitcoins.