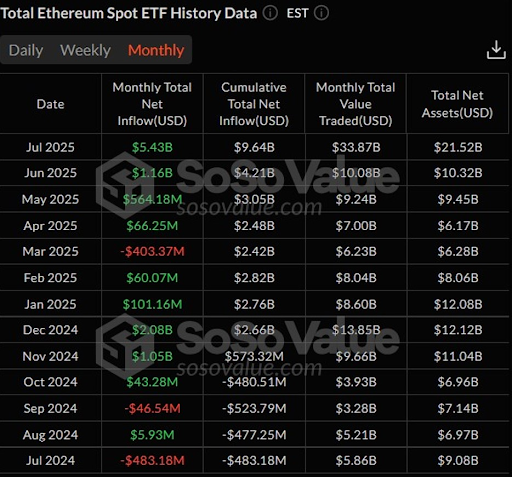

In a powerful demonstration of investor confidence, Spot funds negotiated in exchange for Ethereum (ETF) broke all records in July with $ 5.43 billion in net entries. It marks the highest monthly influx since their starts in the market and reflects a sharp increase of 369% compared to the June 1.16 billion intrigue.

With 20 consecutive days of net inputs, the FNB Spot ETH growing role As a leading digital actor in the eyes of traditional market players.

The ETHE ETHE ETHS reached a milestone with an influx of $ 5.43 billion

According to data From Sosovalue, the net influx of $ 5.43 billion in July also overshadowed $ 564 million in May and $ 66.25 million in April. It completely reversed the negative output trend observed in March, which had a drop of $ 403 million. Following this increase, the net entries accumulated in all the Ether Spot Ether have now reached $ 9.64 billion, showing an increase of 129% compared to June total cumulative.

Related reading

Massive growth has not stopped at entries alone. Total net assets in all ETH spots jumped $ 21.52 billion, dollar $ 10.32 billion a month earlier. These funds now represent 4.77% of Ethereum’s entire market capitalization, showing that ETFs become a bridge for the capital entering the ETH market.

Institutional interest played a role in this growth as a Blackrock Etha remains The first ETF ETF spot by assets, pulling $ 18.18 million on July 31 and now holding $ 11.37 billion. Feth de Fidelity also won $ 5.62 million on the same day, which increased his net assets to $ 2.55 billion. The Graycale Ethe still manages a solid asset base of $ 4.22 billion, even with an exit of $ 6.8 million, showing its continuous relevance.

ETF price rallies, ETF entries reach new heights

THE FNB records Also aligned with a net price rally in ETH throughout July. ETH started $ 2,486 and climbed to a summit of $ 3,933, an increase of almost 60%, the month. At the end of the month, he had settled at $ 3,698, which made the highest monthly decision in July in Ethereum since October 2021. key engine Behind this wave, showing that more capital in space can have directly stimulated the feeling and market prices.

Related reading

ETH rally has also marked the longest Handy monthly candle in almost three years. As the prices went up, the ETF Spot recorded their long -term daily sequence, 20 days in a row without a single outing after July 8. day gains came in the middle of the month, including $ 726.7 million on July 16, $ 602 million on July 17 and $ 533.8 million on July 22.

Ethereum could contest its summit of $ 4,878, established in November 2021, as its growing role in decentralized finance and the growing use Regulated investment vehicles could help the assets. If the current rhythm Entrances and commercial activities continue, he could soon take the front of the stage in a wider market cycle led by Altcoin.

Felash star image, tradingView.com graphic

(tagstotranslate) ETH (T) ETH news (T) ETH Prix (T) Ethereum (T) Ethereum News (T) Ethereum Prix (T) ETHUSD (T) ETHUSDT

Source link