- The Jupiter’s buyout program has reached $ 19 million with $ 79 million to do

- However, JUP’s price remained slow, despite the program

The annual buyout program of $ 100 million in Jupiter has not benefited JUP Traders and holders, as planned. TThe buyout program announcement In February, he would have acquired $ 19 million in JUP.

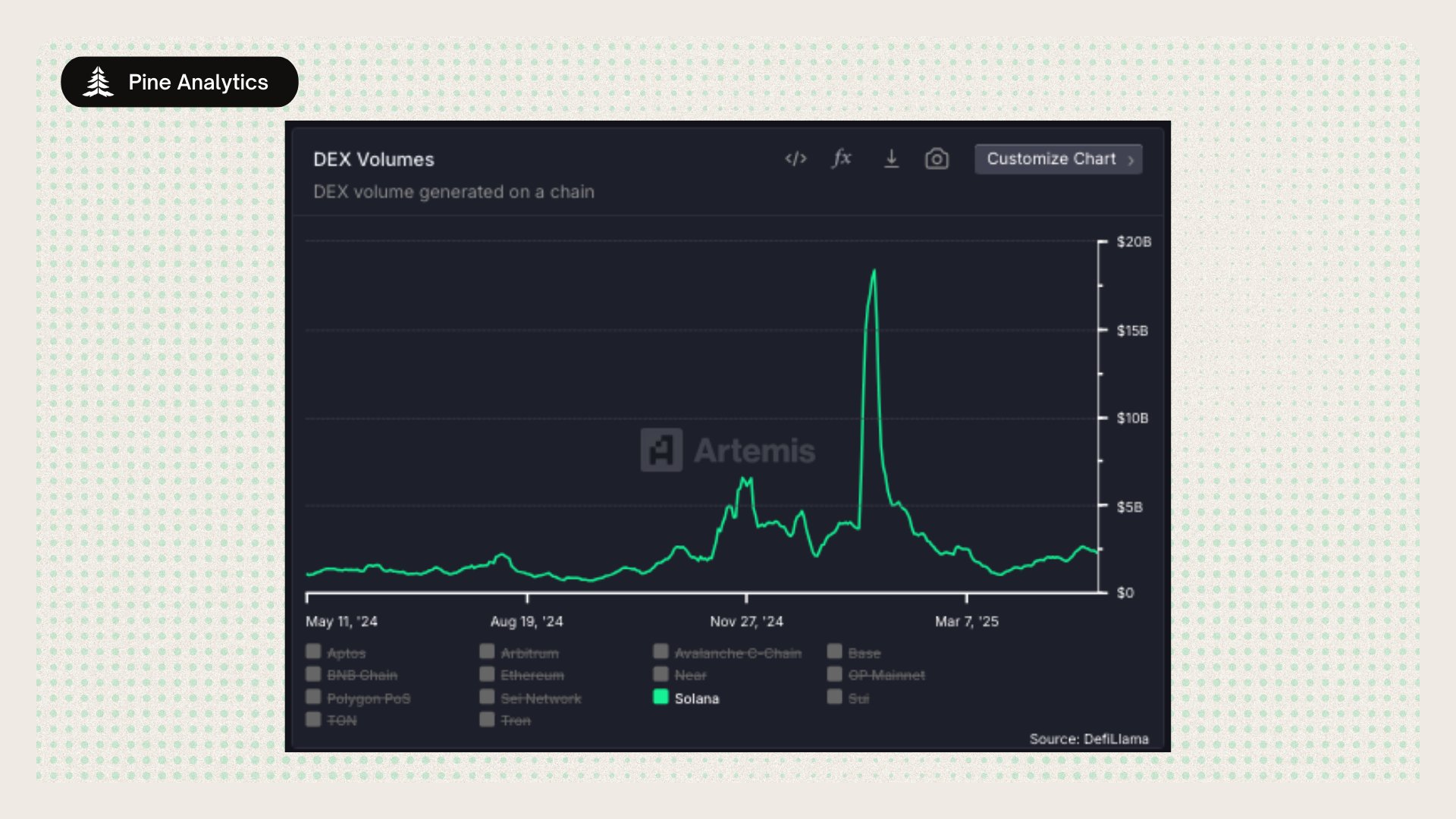

Source: Analytical pine

However, the token dropped 15% of the average price of $ 0.50 of Jupiter for the buyout program, according to a recent report by the research company Pine Analytics.

Which JUP capped is upside down?

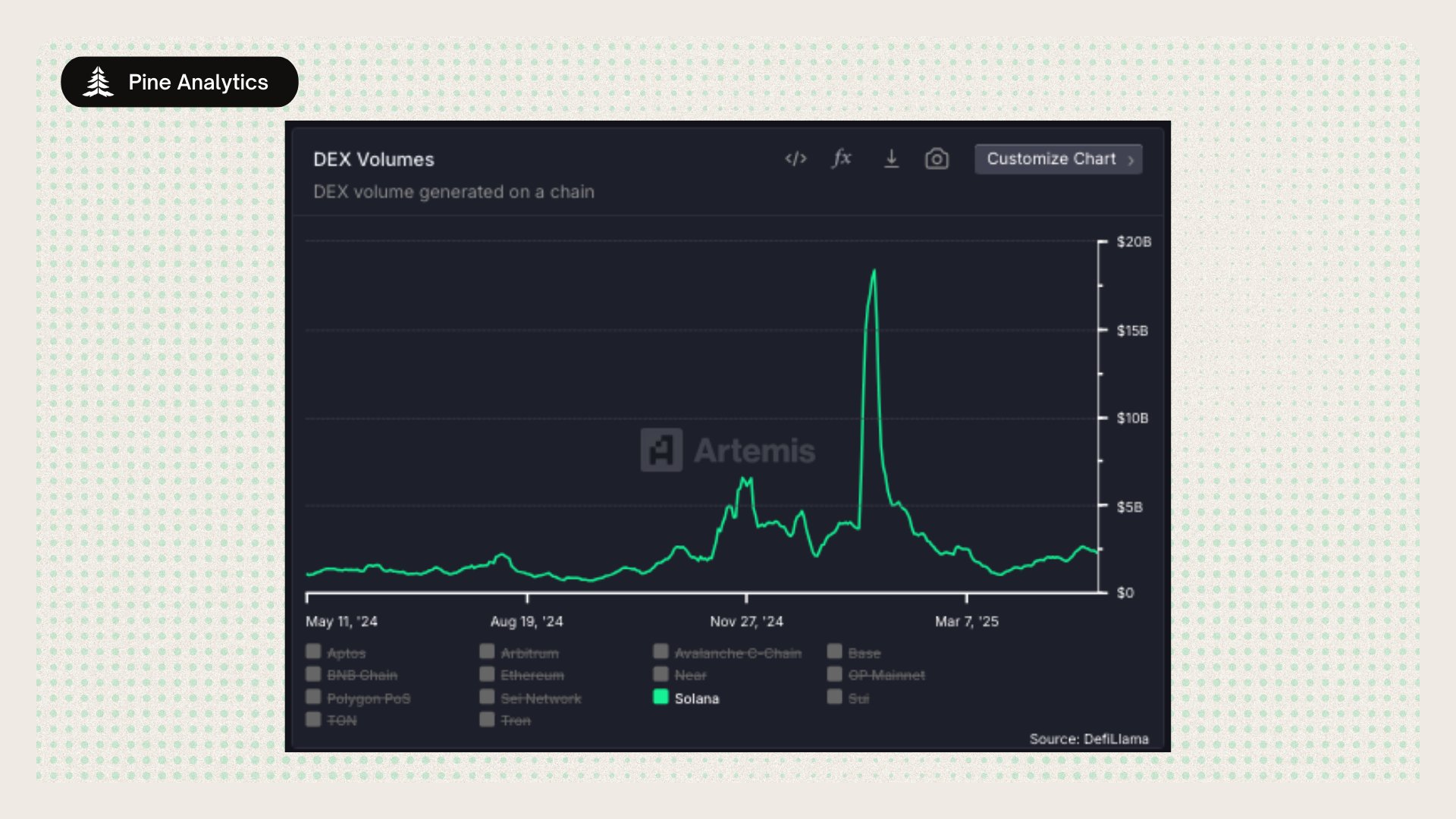

Pine Analytics noted that the price of JUP may have been capped due to the overall contraction in the first quarter, citing a sharp drop in activity on the chain in Solana DEX (decentralized exchange).

Source: Artemis

In addition, the dilution in tokens can also be blamed for the lere price action. In January 2025, 700 million JUPs were unlocked (7% of the offer) for the Jupuary Airdrop.

Interesting fact, around 27% of the overall token offer was unblocked In 2025, more than 5 billion JUPs are still locked and could work the price when this offer arrives on the market.

That said, the snapshot of the weekly market revealed a slight accumulation during the first week of May. According to Coinglass Netflows, more than $ 4 million in JUP tokens have been moved from exchanges – a sign of modest accumulation.

Source: Coringlass

According to Hyblock, whales reduced their positions, which coincided with the drop in prices from $ 0.5 to $ 0.41. The $ 0.41 zone could be a short -term potential support for a Haussier reversal.

However, such a recovery can only be possible if RSI improves and exceeds 50 again to demonstrate a renewed purchase pressure.

Source: Hyblock