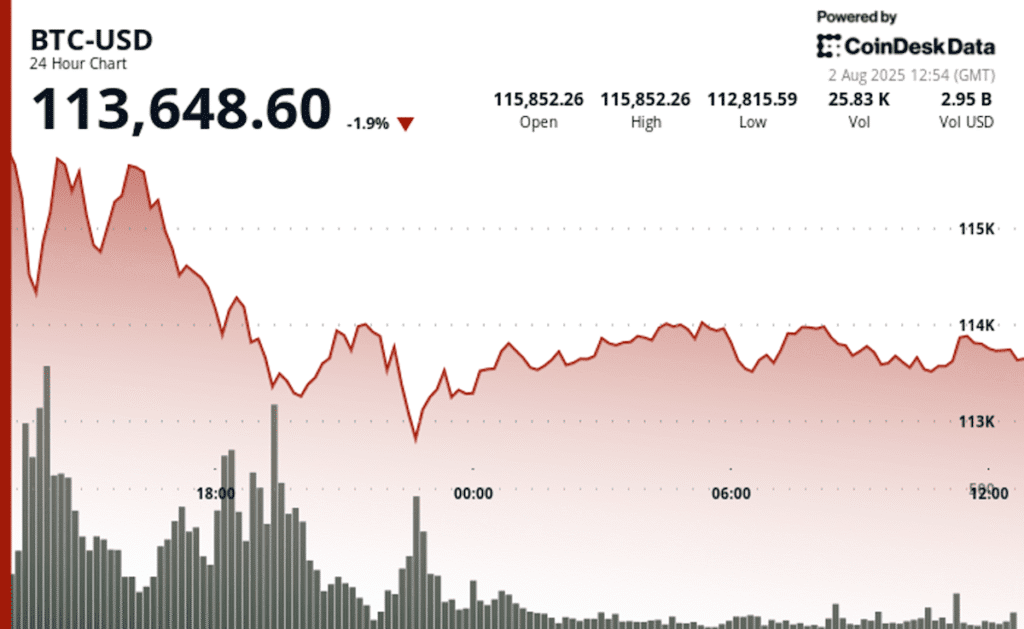

At the time of writing the editorial staff, according to Coindesk data, BTC was negotiated at around $ 113,648, down 1.4% in the last 24 hours. ETH, XRP, SOL and DOGE displayed higher drops, with ETH down $ 3.7% to $ 3,503, XRP reduced from $ 2.94 to $ 2.94, soil down 2.7% to $ 164.13 and DOGE dropped from $ 3.7%.

Friday, the slowdown followed a series of economic and geopolitical shocks that rocked the feeling of investors in the equity and digital markets.

American shares also closed the drop on Friday, with the DOW down 1.23%, the S&P 500 of 1.6%, and the composite Nasdaq plunging 2.24%while the merchants digested a disappointing job report, increased tensions with Russia and the possibility of relieving monetary emergency.

The American Labor Statistics Bureau (BLS) said on Friday that the US economy added only 73,000 jobs in July – well below expectations. More disturbing, however, was a revision downwards of 258,000 jobs for the combined totals in May and June, effectively efforcing most of the labor market gains previously reported for the second quarter.

The unemployment rate remained at 4.2%, but long -term unemployment increased from 179,000 to 1.8 million. The number of new entrants to the labor market jumped 275,000, indicating that more Americans are looking for work but find it difficult to find it. Participation in the active population was held stable at 62.2%, while the employment / population ratio fell from year to year.

Although employment growth continues in health care and social assistance, employment in most of the main industries – including manufacturing, construction, financial services and technology, has little or not changed. The markets have interpreted the data as a clear signal that the labor market is weakening faster than expected.

President Trump responded quickly and publicly to the report on jobs, displaying a scathing message on Truth Social who accused the office of Commissioner for Labor Statistics Erika Mcentarfer – a person appointed by Biden – of manipulating data on employment as the 2024 elections approached.

“This is the same Bureau of Labor Statistics which overestimated job growth in March 2024 of around 818,000 and, once again, just before the presidential election of 2024,” wrote Trump. “They were records – no one can be so false?”

He added: “I ordered my team to dismiss this named Biden policy, immediately.”

The position alarmed investors, who considered rhetoric as a politicization of American statistical institutions. The deletion of a federal official responsible for economic data, based on allegations of election biases, added to the volatility of Friday, in particular for assets sensitive to rates and at risk such as crypto.