Aave is considering a $50 million annual token buyback, testing whether “Aavenomics” can translate protocol revenue into price support.

The Aave DAO is considering a major update to its token policy that would make buybacks a permanent part of its system.

A new proposal published on Wednesday suggests setting up an annual $50 million AAVE token buyback using protocol revenue.

(Source: AAVE Governance)

The plan, which will be introduced by the Aave Chan Initiative (ACI), suggests buying between $250,000 and $1.75 million every week or so.

They would be managed by TokenLogic and the Aave Finance Committee (AFC), and their amount would vary depending on market conditions, liquidity and profits.

This would become a standard part of Operation Aave, giving buybacks a permanent place, rather than the pilot program they currently are.

DISCOVER: Do you have Dogecoin? Count it towards your mortgage – and why the brothers are throwing it into Maxi Doge

Can Aave’s $169 million in annual revenue support a $50 million buyout?

The proposal suggests that the program would establish a long-term buyout of AAVE with the help of revenue generated by the protocol.

There would be some flexibility within the AFC, between 75% of weekly amounts, subject to available funds and market trends.

The second stage involves a snap poll, followed by a chain vote to implement the policy, if the poll is successful.

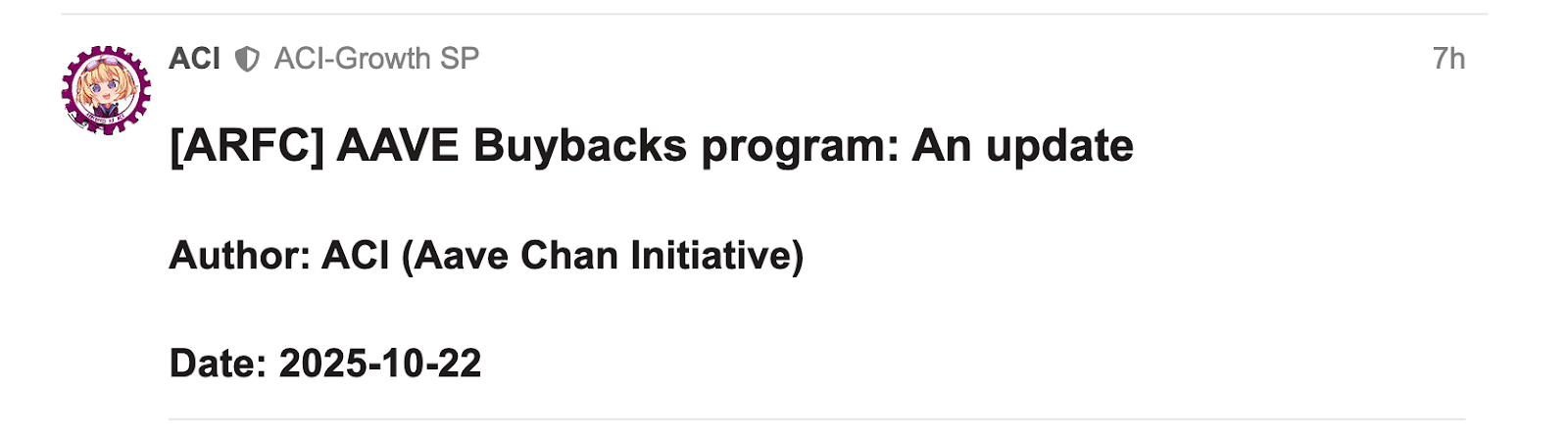

DeFiLlama data report that the protocol has received approximately $13.9 million in the last 30 days and at a rate of approximately $169 million per year.

(Source: DeFiLlama)

This level of revenue would comfortably fund a $50 million annual buyout, even after covering other operational expenses.

Initial feedback from the community has been mostly positive. Aave founder Stani Kulechov said he supports increasing the buyout target to $50 million per year.

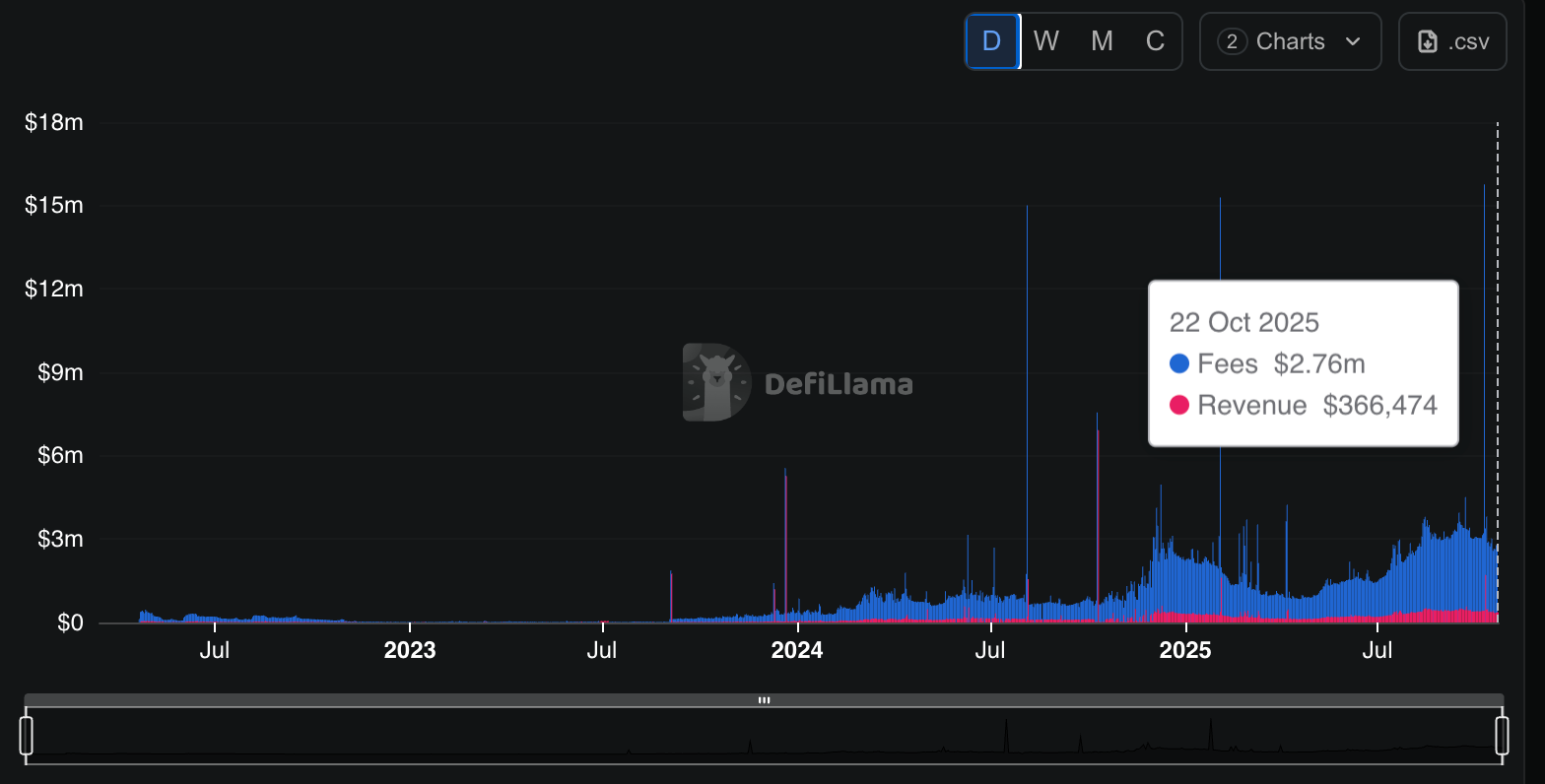

Of the press timeAAVE was trading near $218, down about 5% for the day, with prices fluctuating between $215 and $231.

Market reactions remain mixed, but the governance update has drawn attention to whether consistent buybacks can help stabilize the token amid broader volatility.

The proposal arrives just before Aave v4 deployment expected end of 2025.

The upgrade will introduce a “hub-and-spoke” framework aimed at pooling liquidity more efficiently and managing risk across smaller market modules, a structure that could affect the protocol’s revenue and, therefore, its ability to support redemptions.

DISCOVER: Best Meme Coin ICOs to invest in 2025

AAVE Price Prediction: Is AAVE heading towards the $135 “magnet” zone highlighted by analysts?

Technically, the AAVE price chart signals pressure. The token is struggling to hold key support levels.

Analyst Ali Martinez describe $135 as a “magnet” for AAVE, suggesting that a break below current levels could trigger a deeper pullback.

The token collapsed below its mid-range support of $250, which received significant buying support earlier this year.

(Source:)

On the technical side, a lower and lower trend is now apparent in the chart, indicating a short-term decline.

The second support is near $215, but the introduction of the $135 area by analyst Ali Martinez indicates that a larger correction could come if sentiment remains weak.

This is a level that has traditionally been in high demand and is worth pursuing in the future.

Resistance lies near $360, where past rallies have stalled. A steady break above $250-$270 would reverse the pattern and allow a rebound.

For now, momentum is weak and repeated failures to reclaim $270 show that buyers are not in control.

Liquidity is low and traders continue to turn to Bitcoin and Ether. If AAVE fails to reclaim its former support, a move towards $135-150 in the coming weeks is on the table.

The trend remains bearish as long as the price remains below $250. Traders are watching to see if AAVE can establish itself here or slide towards the lower demand zone pointed out by Martinez.

EXPLORE: The 12+ Hottest Cryptocurrency Presales to Buy Now

The article Aavenomics Major Update: Will the Buyback Proposal Increase the Price of AAVE? appeared first on 99Bitcoins.