Bitcoin is above key support levels while continues to consolidate just below the $ 112,000 summit. Despite the creation of Momentum Haussier on the wider market of cryptography, BTC had trouble recovering this level of critical resistance, keeping traders on board. Analysts agree that a decisive break is necessary to confirm the upward trend and report the start of a new phase of expansion.

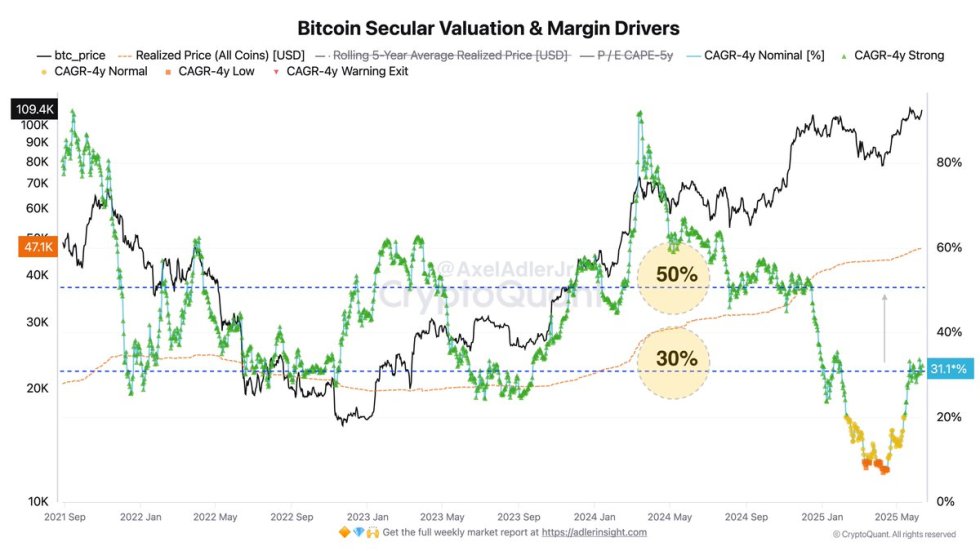

According to data on the cryptochant chain, the recent recovery in the annual growth rate of Bitcoin compounds (TCAC) highlights a long -term change of feeling on the market. After plunging just 7% in April – reflecting the compressed margins and exhaustion of the cycle – the TCAC has now rebounded at around 31%, which falls into what analysts consider the “strong zone”. This resurgence occurred while the BTC price has joined $ 110,000 in May-June 2025, release the hopes of a sustained optimistic trend.

Although the current growth rate remains lower than the peaks of the historic cycle of 50 to 80%, the market structure and the dynamics on chain suggest that there is still a lot of upward space. While Bitcoin holds its field and market terms, the scene can be defined for a decisive break – one that could confirm the upward trend and drive BTC again to discover prices.

Bitcoin is preparing for the price discovery as fundamentals strengthen

Bitcoin is about to enter the price discovery, the assets negotiating just below its top of all time almost $ 112,000. After weeks of consolidation and higher stockings, this week could prove to be decisive for the entire cryptography market. A break above the resistance would signal the start of an explosive new phase, while withdrawal to sweep the liquidity below remains a valid risk if the amount of movement. In any case, the market is preparing for an important decision.

This critical moment comes in the midst of increasing macroeconomic uncertainty. The American economy continues to show signs of systemic stress, driven by high cash yields, sticky inflation and geopolitical tensions. Despite these opposite winds, the Bitcoin structure remains strong, sustained by improving long -term fundamentals.

The high -level analyst Axel Adler shared the ideas of cryptocient, pointing to the rebound of the annual growth rate composed of 4 years of Bitcoin (TCAC). After dropping only 7% in April – shifting a seriously compressed market – TCAC is given to 31% by June 2025, entering what Adler calls the “strong zone”. This rebound coincided with the rise of Bitcoin around $ 110,000, strengthening the Haussier feeling.

While 31% remain below the Historic Pic TCACs of 50 to 80%, Adler notes that the backdrop is favorable. If the momentum and the leverage of the long -term market continue to build, it plans that Bitcoin could reach $ 168,000 in October 2025. For the moment, all the eyes are on the next BTC movement, because whatever the direction it breaks, this will probably set the tone for the rest of the year.

BTC is consolidated below Ath: Market awaits the next movement

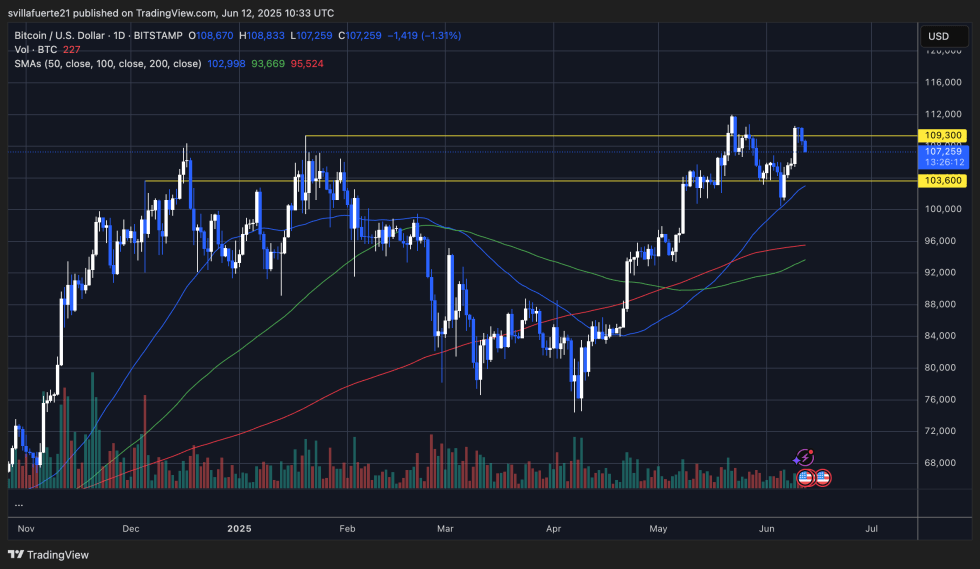

Bitcoin is currently negotiated at $ 107,259 on the daily graph after a minor withdrawal of 1.31% compared to the resistance level of $ 109,300. The price action shows that BTC forming a range between $ 103,600 (support) and $ 109,300 (resistance), with several refusals of the upper limit. Despite this, Bitcoin continues to keep the simple 50 -day mobile average (SMA) at $ 102,998, which suggests that the wider trend remains intact for the moment.

This consolidation comes after the BTC strongly rebounded in the $ 103,600 support area earlier this month. The structure is always constructive, but the bulls must recover and maintain above the level of $ 109,300 to challenge the top of $ 112,000 and push in the discovery of prices. Not doing it could lead to a retest of $ 103,600, where liquidity is probably concentrated.

The volume remains relatively stable, although slightly lower than this last step, alluding to this momentum. That said, as long as BTC holds above the key mobile averages and does not close below $ 103,600, the bullish structure is preserved.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.